Thailand faces rising turmoil as U.S. tariffs loom, exports slump and political tensions flare. Amid the chaos, six contenders vie to lead the central bank, with reform calls growing louder ahead of the June 24 series of presentations that could possibly reshape monetary policy.

As Thailand navigates a storm of political uncertainty and braces for the potential impact of the Trump tariff regime after July 9th, the country is also in the process of selecting a new leader for the Bank of Thailand. The central bank has played a vital role in recent years, effectively safeguarding the nation’s financial stability and external reserves. However, at least one contender for the position believes it’s time for change. On Sunday, Dr. Anusorn Thamjai of the University of the Thai Chamber of Commerce (UTCC) unveiled a bold reform plan aimed at overhauling the banking system. His announcement comes ahead of formal presentations by candidates scheduled for June 24th. Meanwhile, Fitch has downgraded its outlook for the Thai banking sector but has, for now, maintained its credit rating.

Thailand is entering a period of heightened uncertainty. The expiration of a U.S. tariff suspension on July 9 threatens exports. Meanwhile, political instability is rattling markets and analysts alike.

In June, export figures are reported to be struggling and set to fall sharply. This decline may yet be one of the steepest drops in over a year. Analysts attribute this to fears surrounding renewed U.S. tariffs and weakening global demand. Additionally, businesses remain cautious as borrowing levels decline and liquidity slumps.

This week, Fitch Ratings downgraded its outlook for Thailand’s banking sector. The agency shifted the sector’s forecast from “neutral” to “deteriorating.”

Fitch warns Thai banks face rising risks from trade slowdown and tightening liquidity conditions

Notably, Fitch also lowered outlooks for South Korea and Taiwan.

Fitch cited weakening credit growth and profitability. It warned that the global trade slowdown, worsened by U.S. tariffs, could hit banks hard. Thailand’s export-heavy economy remains especially vulnerable. Therefore, its banking system is at greater risk of stress.

Although Fitch maintained Thailand’s sovereign and banking ratings, its tone was cautious. According to the agency, liquidity is tightening across the economy. This is especially true at the grassroots level. Borrowing has also dropped, suggesting banks are retreating from risk.

In particular, Fitch warned that asset quality could deteriorate in 2025. As profits shrink, banks may face rising default risks. However, Fitch does not expect a sharp economic collapse. The labour market remains steady, helping to prevent more serious damage.

Since the post-COVID-19 recovery, banks have regained some resilience. Profitability has improved compared to pandemic lows. Yet, Fitch expects that even this may weaken next year. The sector faces mounting pressure from domestic and global uncertainty.

BOT governor race begins amid debate over reform and central bank’s role in boosting growth

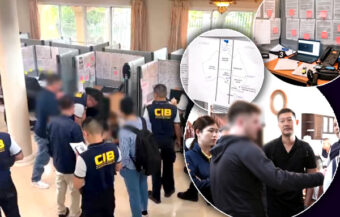

At the same time, key structural changes are underway. On June 24, six candidates will present their vision for leading the Bank of Thailand (BOT). This presentation marks the next step in the governor selection process.

The new BOT governor will begin in October 2025. This leadership change comes at a pivotal time. The central bank has become the economy’s anchor in recent years. However, some critics argue that it has prioritized stability over growth.

One candidate, Dr. Anusorn Thamjai, has already outlined a bold reform plan. On Sunday, he proposed a banking system overhaul to increase flexibility. His goal is to stimulate real-sector growth and raise GDP expansion back to 4–5%.

According to Dr. Anusorn, existing monetary policies have stifled credit for small businesses. He aims to increase lending to this sector. He also supports easing liquidity constraints at the grassroots level. If appointed, his leadership could shift the BOT’s current direction.

Interest rates are likely to hold steady as policymakers await tariff decisions and global developments

In the near term, monetary policy remains in a holding pattern. The Kasikorn Research Center expects the Monetary Policy Committee (MPC) to maintain interest rates. It forecasts that the policy rate will remain at 1.75% during the June 25 meeting.

So far in 2025, the MPC has already cut rates by 0.50%. However, analysts believe that further cuts are possible. For now, the committee is likely waiting to assess the full impact of U.S. tariffs.

Importantly, July 9 marks the deadline for the current U.S. tariff delay. This decision could significantly affect Thailand’s trade outlook. If tariffs return, exports may fall even further in the second half of 2025.

Furthermore, geopolitical instability in the Middle East remains a key concern. Oil prices have risen in response to regional tensions. The central bank remains cautious because Thai inflation is closely linked to energy prices.

Inflation stays low but financial stress persists across low-income households and small businesses

Despite these pressures, inflation remains relatively low. This is due to weak domestic demand and rising imports. Thus, the MPC may feel more comfortable cutting rates later in the year.

In addition, the BOT has introduced non-traditional measures to address financial stress. One such policy is the “You Fight, We Help” program. It is designed to relieve the debt burden on vulnerable groups. The measure targets individuals and businesses struggling with repayments.

Still, overall bank lending remains weak. In the fourth quarter of 2024, total bank loans declined by 0.4%. Hire purchase credit also continued to fall. Meanwhile, low-income groups have seen only modest income recovery.

Looking ahead, Kasikorn Research Center expects at least one more rate cut in 2025. The second half of the year is expected to see deeper economic slowing. Exports are projected to contract further. Tourism numbers have also fallen since February.

Tourism outlook dims and political delays may force the central bank to act again to support the economy

Crucially, no rebound in tourism is yet visible. If trends continue, the sector may contract for the first time in three years. This would deliver another blow to GDP growth.

In addition, concerns about government stability have returned. Political uncertainty may delay budget disbursements. This, in turn, could harm public investment and erode consumer confidence.

As a result, the MPC may need to act again soon. Any further rate cuts will depend on inflation and economic data in the coming months. The new BOT governor will also play a major role in shaping future policy.

The BOT governor selection process is now in its final stages. On June 20, the Ministry of Finance confirmed that six candidates met all qualifications. One applicant, Mr. Wikrant Supamongkol, failed to meet eligibility rules due to company size criteria.

Final candidates for BOT governor present policy plans before a decision is sent for royal appointment

Each of the six remaining candidates will have 30 minutes to present their policy vision. Following this, the selection committee will conduct interviews. The chosen candidate will be submitted to the Cabinet for royal appointment.

The six contenders are:

Mr. Witai Rattanakorn – Director of the Government Savings Bank

Dr. Suttapa Amornvivat – CEO of Abacus Digital Co., Ltd.

Dr. Somprawin Manprasert – Former EIC Head, Siam Commercial Bank

Dr. Kobsak Pootrakool – Deputy Managing Director, Bangkok Bank

Dr. Rung Mallikamas – Deputy Governor for Financial Institution Stability, BOT

Dr. Anusorn Thamjai – Dean, Faculty of Economics, University of the Thai Chamber of Commerce

Each candidate brings distinct experience and priorities. Their vision for the BOT could shape monetary policy for years to come. Therefore, the upcoming selection is seen as highly consequential.

Uncertainty deepens as BOT prepares for leadership change amid rising risks to growth and stability

Undoubtedly, Thailand is facing a volatile and uncertain second half of 2025. Exports are weakening, tourism is slipping and political noise is rising. Meanwhile, central bank leadership is in transition.

Liquidity crisis or shortage of cash on the ground is shrinking Thailand’s economic growth prospects

Although economic fundamentals remain intact, risk factors are growing. Much depends on U.S. trade policy and global energy prices. Domestic politics may also complicate fiscal efforts.

With the BOT preparing for a new governor and interest rates near historic lows, policy flexibility will be key. Whether Thailand can reignite growth will depend on timely action, clear vision, economic resilience and of course a touch of good luck, sadly missing so far this year.

Join the Thai News forum, follow Thai Examiner on Facebook here

Receive all our stories as they come out on Telegram here

Follow Thai Examiner here

Further reading:

Liquidity crisis or shortage of cash on the ground is shrinking Thailand’s economic growth prospects

Thai Minsters engage with US trade chief Jamieson Greer in Paris at global OECD ministerial meeting

Commerce Minister meets US trade boss Jamieson Greer in Korea. Paul Chambers case still dogs talks