Bangkok police bust a loan shark gang using iCloud access to lock iPhones if borrowers missed payments. The gang charged a brutal 365% yearly interest and late fees. Over 5,000 victims handed over control of their phones and personal data, risking blackmail and identity theft. Authorities warn the public.

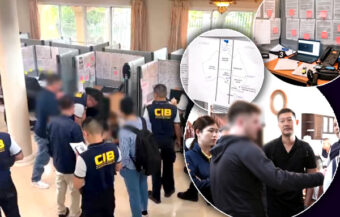

Police in Bangkok have dismantled a predatory loan operation that targeted thousands of Apple iPhone users with extortionate lending terms. The scheme involved securing loans by taking control of borrowers’ iCloud accounts, giving the lenders remote access to lock users out of their own devices. Borrowers who missed repayment deadlines were locked out of their phones and pressured into paying hefty late fees. On Friday, police raided the group’s headquarters and seized evidence linked to the illegal operation. Authorities later issued a warning, urging the public not to hand over iCloud access to third parties under any circumstances. Such access, officers said, poses a serious security risk. It can allow criminals to blackmail users or steal personal data, including private messages, photos, and sensitive documents.

Police in Thailand have taken down a predatory loan gang that used Apple iCloud accounts as loan collateral. The arrests followed a months-long investigation into IT Money Co., Ltd., a company accused of offering illegal personal loans with excessive interest rates and unethical terms.

The scheme targeted iPhone users in urgent need of money. Borrowers were required to hand over control of their iCloud accounts. If they missed a payment by more than seven days, their phones were locked remotely. Consequently, many victims lost access to personal and work-related data.

Authorities said the company charged up to 30% monthly interest. That’s the equivalent of 365% per year. In addition, borrowers faced daily late fees and extra charges to unlock their phones.

Police bust iPhone loan syndicate locking users out of phones for missed payments and late fees

The Economic Crime Suppression Division (ESD) led the crackdown. It was part of an operation called iLockdown. The enforcement action was ordered after a complaint was filed with the Technology Crime Suppression Division (TCSD).

The victim reported that IT Money Co., Ltd. was exploiting borrowers. They claimed the company disguised illegal loan contracts under the appearance of legitimate business deals.

After verifying the complaint, police obtained a court warrant to search four company locations. The raids took place on June 20.

Authorities searched IT Money’s head office and three branches. These included locations in Samrong Nuea, Phra Pradaeng, and Nuan Chan districts of Bangkok. Officers seized documents, devices, and digital records.

The searches led to the arrest of five key suspects. Mr. Atthaphon Samranchai, 38, was identified as the company’s director. Ms. Pratana Koman, 29, acted as an administrator and handled bank transfers. Additionally, five accomplices were also detained at the sites.

Raids on four Bangkok sites lead to arrests of key suspects running the high-tech loan shark business

All suspects were charged with operating a loan business without a license. They were also accused of charging interest rates far above the legal limit.

According to investigators, the loan application process was invasive and complex. First, potential borrowers had to submit their iPhones for inspection. The company checked the device model and battery condition. This step ensured the phones held enough resale or ransom value.

Next, applicants received a digital form. They were required to fill out personal details including full name, ID number, current address, workplace, and phone number.

Furthermore, the form requested sensitive digital information. Borrowers had to enter their IMEI number, Apple ID, and Apple ID password. This gave the company full access to the device via iCloud.

In addition, borrowers needed to meet certain online credibility criteria. For example, they had to have at least 500 Facebook friends. They also needed a history of regular social media activity. This was presumably to prove identity and reduce fraud risk.

Victims forced to give Apple ID passwords and pass social checks to receive highly predatory loans

Once approved, borrowers had two options to sign the loan contract. They could visit a branch in person or complete the process online. If they chose the online route, they were asked to upload a photo of their national ID card.

After the contract was finalized, the borrower received the funds. They could continue using the phone. However, if payments were late by more than three days, a ฿100 daily fine was added. If a payment was more than seven days overdue, the phone was immediately locked through iCloud.

Unlocking the device involved an additional fee. In many cases, the borrower could not afford to pay both the interest and the unlocking charge. As a result, they were cut off from their phones and all stored information.

Preliminary investigations uncovered over 5,000 victims. Most had no idea the terms were so harsh. Many were desperate for fast cash and agreed without understanding the risks.

Thousands lost access to phones and data under contracts they barely understood or could repay

Police believe that borrowers’ personal information is also at risk. Not only did victims lose access to devices, but their sensitive data could be exploited. This includes photographs, work documents, and even company records.

According to the ESD, leaked information might be used for blackmail or fraudulent activity. In some cases, company files stored on the phones could pose a threat to employers or organizations.

The Central Investigation Bureau (CIB) issued a strong warning. They urged the public to avoid giving out iCloud credentials. Doing so hands over complete control of a device. It may allow outsiders to monitor, copy, or manipulate private data.

Furthermore, giving up digital credentials can lead to long-term harm. Stolen information can be used for identity theft, extortion, or further scams.

Police warn victims’ data could be weaponised by gangs for blackmail, extortion or identity theft

Officials reminded the public that loan sharks often prey on vulnerable people. These criminals offer quick cash but hide extreme terms in small print. If a deal seems too easy, it likely comes with hidden costs.

Pol. Maj. Gen. Thatsaphum Charuprat, who led the operation, praised the joint efforts of all agencies involved. He said the crackdown shows Thailand’s commitment to fighting financial cybercrime.

Moreover, police emphasized that citizens must report suspicious lenders. The sooner scams are reported, the faster action can be taken.

Authorities warn public to watch for too-good loan offers and report suspicious lenders immediately

This case serves as a cautionary tale. While smartphones are useful tools, they can become liabilities in the wrong hands. iCloud accounts are not just storage—they’re digital lifelines.

Authorities are continuing their investigation. They will analyze the seized data to track down more victims and trace the gang’s financial records. If found guilty, the suspects could face heavy fines and prison terms.

Husband of borrower with breast cancer mowed down loan shark after he refused a pause in payments

Police arrest callous loan sharks who murdered 45-year-old trader over ฿400 in missed payments

Meanwhile, victims are encouraged to come forward. Police will assist with device recovery and data security. A dedicated hotline has been set up to help affected individuals.

Thailand’s financial crime watchdogs say this is just the beginning. More digital loan scams are under investigation. As financial technology grows, so do the risks.

Join the Thai News forum, follow Thai Examiner on Facebook here

Receive all our stories as they come out on Telegram here

Follow Thai Examiner here

Further reading:

Husband of borrower with breast cancer mowed down loan shark after he refused a pause in payments

Government’s household debt efforts in addition to plans to inject ฿500 billion into the economy

Srettha’s crisis is not just an economic one, it is a ‘3D debt crisis’ that is strangling GDP growth

Zombie Thai firms holding back economic growth as they struggle just to pay interest on bank debt

Incoherent government economic policy clashes with Bank of Thailand’s efforts to rein in debt