US strikes on Iran and threats to block the Strait of Hormuz risk soaring oil prices. Thailand faces inflation, supply disruptions and pressure on its Oil Fund. Tourism and exports are also at risk as the government prepares for possible energy and economic shocks.

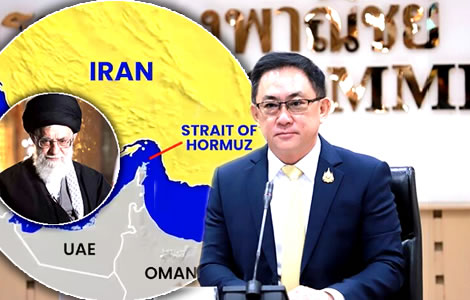

A fresh crisis has slammed into the Thai government after U.S. strikes on Iran’s nuclear facilities over the weekend. In a swift and dangerous response, Tehran is threatening to choke off the Strait of Hormuz—the world’s most critical oil artery. This narrow waterway moves nearly a fifth of global oil. Shutting it down would send shockwaves through global markets—especially in Asia. China and regional economies rely heavily on crude flowing through these waters. A blockade would be catastrophic. Thailand’s Ministry of Commerce is sounding the alarm. Officials warn that soaring oil prices will punch straight through to domestic inflation, hurting households and businesses alike. The risks don’t stop there. A disruption at Hormuz threatens to derail exports, scramble supply chains and damage global trade just as recovery gains traction.

Tourism—another economic pillar—is also in the crosshairs. Higher airfares and regional instability could scare off travellers, slashing demand and hitting revenues hard.

But the most immediate threat? The survival of Thailand’s Oil Fund. This fund is the last line of defence against runaway fuel prices. It underpins energy affordability and shields the economy from global volatility. If pressure mounts, the fund could buckle—triggering a spike in living costs and public anger.

The Strait of Hormuz isn’t just a distant geopolitical flashpoint. It’s a trigger that could ignite a full-blown economic emergency here at home.

Ministry warns rising oil prices could spiral out of control due to Israel-Iran conflict and blockade fears

The Ministry of Commerce has issued a warning about rising oil prices following the Israel-Iran conflict. Oil prices have climbed 13% since June 13, when Israeli forces attacked Iranian targets. The conflict has triggered global concern over energy security and trade routes.

According to Mr. Poonpong Naiyanapakorn, Director of the Office of Trade Policy and Strategy, the Strait of Hormuz is at the centre of this crisis. Iran’s parliament has supported closing the Strait in retaliation against U.S. involvement. This narrow passage is one of the world’s most important oil transport corridors.

On average, 20 million barrels of oil move through the Strait each day. That volume accounts for 25% of global seaborne oil trade. It also represents about 20% of total world liquid petroleum consumption.

Moreover, the Strait of Hormuz is vital for the economies of the Middle East. It serves as a lifeline for oil and gas exports from Saudi Arabia, the United Arab Emirates, Iran, Qatar, Bahrain and Kuwait. These nations depend on this route to access markets around the world.

Asia’s energy security in jeopardy as 84% of Gulf oil heads east through the Strait of Hormuz chokepoint

In particular, Asian countries heavily rely on this supply chain. The U.S. Energy Information Administration estimates that 84% of the crude oil and LNG shipped through the Strait in 2024 went to Asia. Thus, any closure would significantly affect countries like China, Japan, South Korea and India.

If shipping through the Strait is halted, tankers must detour around Africa. This longer route would raise transport costs, increase delivery times and push energy prices even higher.

Consequently, global inflation could rise. Economic uncertainty would increase. Energy-importing countries, including Thailand, would face greater pressure.

The situation has already caused extreme volatility in oil markets. After U.S. strikes on Iranian nuclear sites, Brent crude rose to a five-month peak. Since June 13, prices have increased by more than 13%.

Investment bank Goldman Sachs has released several impact scenarios. In one scenario, if Strait traffic drops 50% for a month, Brent crude could hit $110 per barrel. Prices would then fall slightly but still remain elevated. By the fourth quarter of 2025, the price may settle around $95 per barrel.

Blockade threat fuels shipping insurance hikes and cost surges even for nations not importing Iranian crude

In another case, if Iran’s crude output falls by 1.75 million barrels daily for six months, prices could reach $90. Later, by early 2026, they may drop to $60. Goldman Sachs estimates a 52% chance that Iran will attempt to close the Strait in 2025.

Shipping costs have also increased sharply. Freight rates and maritime insurance premiums have risen since the conflict intensified. Insurer Marsh McLennan raised its surcharge for vessels passing through the Persian Gulf. Rates jumped from 0.125% to 0.2% after Israel’s strikes on Iran.

This increase signals rising risk perception in the region. Disruptions in the Strait affect global logistics and supply chains. Thailand, as an oil-importing country, is exposed to these risks.

Thailand relies on foreign energy supplies for nearly 90% of its crude oil consumption. Although Thailand does not directly import crude oil from Iran, over half of its oil imports come from other Middle Eastern nations. These include the United Arab Emirates, Saudi Arabia, Qatar, Kuwait and Oman. All ship oil through the Strait of Hormuz.

Over 50% of Thai energy imports threatened as regional oil flows pass through the Hormuz bottleneck

In 2024, Thailand imported $45.9 billion worth of energy products. Of that, $24.1 billion—or 52.6%—came from the Middle East. Therefore, if the Strait is blocked, Thailand’s crude supply would be heavily impacted.

If the crisis continues, domestic oil prices may rise quickly. Fuel prices directly influence Thailand’s inflation. According to the Ministry of Commerce, fuel contributes 9.57% to the national inflation rate.

Furthermore, Thai exports to the Middle East could also be disrupted. Most goods shipped to the region pass through the Strait en route to Jebel Ali Port in the UAE. This port serves as a major distribution hub for Middle Eastern and nearby markets.

Thailand’s export sectors may suffer delays and higher freight costs. Nonetheless, some industries might benefit. For example, higher oil prices could lift exports of plastic pellets, petrochemicals, refined fuels, and liquefied petroleum gas. These oil-related goods may gain value as global prices rise.

Threat level rises as United States directly enters Iran-Israel conflict raising odds of sustained blockade

Still, Mr. Poonpong warned that the current crisis appears more serious than previous conflicts. Unlike the earlier Israeli-Palestinian war, this is a direct clash between Israel and Iran. The involvement of the United States adds further complexity. As a result, the probability of a sustained shipping blockade has increased.

The Ministry of Commerce is coordinating closely with other agencies. Officials are monitoring developments and conducting ongoing risk assessments. Policy adjustments may follow if the situation worsens.

On Monday, Deputy Prime Minister and Minister of Energy Mr. Pirapan Salirathavibhaga called an emergency meeting at Government House. The meeting addressed urgent preparations for a potential energy crisis.

Officials reviewed contingency plans to secure oil from alternative suppliers. They also examined options to stabilize domestic prices using the National Oil Fund.

Mr. Pirapan noted that 59% of Thailand’s oil imports come from Middle Eastern countries. These shipments must pass through the threatened Strait. Thailand must therefore act quickly to minimize supply disruptions.

Thailand builds contingency reserves and explores tax relief as it braces for multi-week energy shortfalls

He urged the public not to panic. Instead, he asked citizens to use energy sparingly. Reducing energy consumption will help offset rising import costs.

As of June 23, 2025, Thailand holds approximately 3.35 billion litres of crude oil in reserve. This amount covers 25 days of national consumption. An additional 2.85 billion litres are in transit and have already passed the Strait, which is enough for 21 days. The country also has 1.96 billion litres of finished oil, sufficient for 17 days. Altogether, Thailand’s current oil reserves cover 63 days of demand.

Authorities are considering increasing these reserves. They are also looking for substitute sources in Southeast Asia and other regions.

The government may also adjust oil taxes. Mr. Pirapan said the Ministry of Finance might reduce excise duties to cushion rising prices. Meanwhile, the Oil Fund remains a key tool for maintaining price stability.

Oil Fund under pressure as deficits mount and ministry struggles to keep prices from surging nationwide

As of June 22, 2025, the Oil Fund is in deficit by ฿35.4 billion. The cooking gas account is short by ฿44.4 billion, while the oil account is negative by ฿9 billion. Despite this, the Fund was used four times last week to lower gasoline and diesel contributions. These moves aim to reduce the burden on consumers.

Global concern is rising alongside prices. On Sunday, U.S. Secretary of State Marco Rubio urged China to intervene. He asked Beijing to pressure Iran to keep the Strait open.

China is Iran’s largest oil buyer. Last month, China imported over 1.8 million barrels per day from Iran. China also has deep diplomatic and economic ties with Tehran.

If the Strait closes, China will face serious supply disruptions. Rubio called such a closure “economic suicide” for Iran. He warned that many countries—not just the U.S.—would suffer.

Global diplomacy scrambles as China, Iran and the US enter a collision course over Strait tensions

Rubio also emphasized that the U.S. still has options. However, he urged other nations to act swiftly to prevent further escalation. Oil prices reacted immediately. Brent crude opened at $81.40 per barrel on June 23. Later in the day, prices fell slightly to $78—still up 1.4% from the day before.

Prices may remain volatile in the coming weeks. Market confidence hinges on military developments and diplomatic negotiations.

Meanwhile, energy analysts say Iran has more to lose than gain from closing the Strait. The move would anger Persian Gulf neighbours who depend on the same route. It could also alienate China, Iran’s most important oil customer.

The situation remains fragile. The United States recently bombed Iran’s Fordo nuclear facility, deepening the conflict. Iran claimed the site only suffered minor damage. The International Atomic Energy Agency has yet to confirm the extent.

In response, China condemned the U.S. attack. It called for an immediate ceasefire. The Chinese ambassador to the United Nations urged all sides to exercise restraint.

Thailand monitors markets daily as cost-of-living storm builds amid deepening regional military escalation

China’s state-run media echoed that call. The Global Times editorialized that U.S. actions have worsened Middle East instability. It warned of the conflict spiralling out of control.

Back in Thailand, government agencies continue to meet daily. The focus is now on energy security, inflation and trade logistics.

The Ministry of Commerce and the Ministry of Energy have both pledged to act decisively. Officials stress that early planning and public cooperation are essential.

Search for a new central bank boss heats up amid a political and economic storm buffeting the kingdom

Oil still boss as Thailand’s economy faces a return to 1970s stagflation over the ongoing Ukraine war

Washington tries to rein in Israel’s plans to severely damage an Iranian regime behind its enemies

The private sector is also preparing. Thai exporters are considering route diversions and negotiating with shipping lines.

Much now depends on how quickly diplomatic efforts can ease the crisis. Until then, Thailand remains on alert, watching both markets and the Strait. It is yet another crisis for the government in Bangkok. Indeed one which can impact exports, tourism and the cost of living.

Join the Thai News forum, follow Thai Examiner on Facebook here

Receive all our stories as they come out on Telegram here

Follow Thai Examiner here

Further reading:

Liquidity crisis or shortage of cash on the ground is shrinking Thailand’s economic growth prospects

Thai Minsters engage with US trade chief Jamieson Greer in Paris at global OECD ministerial meeting

Commerce Minister meets US trade boss Jamieson Greer in Korea. Paul Chambers case still dogs talks