Elite entrepreneurs unleash convenience store clash: Thailand’s economic tightrope fuels a billionaire brawl as contenders challenge 7-Eleven’s reign. Focused on convenience, moguls like Charoen Sirivadhanabhakdi enter the arena, foreseeing a retail revolution amidst evolving consumer habits.

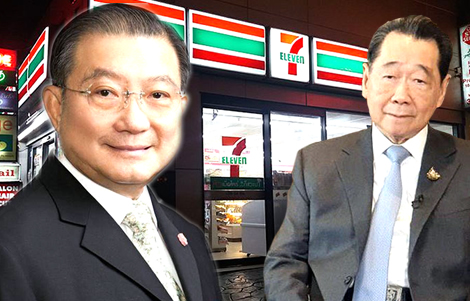

As Thailand’s economy is poised on a knife edge with only enough economic momentum to just about keep moving forward, the country’s wealthy elite are focusing on the convenience store market with at least four upstarts trying to take on the dominance of the still expanding 7-Eleven 24 hour chain run by the kingdoms’ giant conglomerate Charoen Pokphand Group and the influential Chearavanont family.

In what could be an exciting clash of business titans, Thailand’s billionaire tycoons are making strategic investments into the burgeoning convenience store sector, foreseeing a surge in demand as consumer habits evolve towards frequent, smaller purchases.

This bold initiative comes at a crucial juncture, with conflicting views emerging on the trajectory of personal consumption in Thailand, influenced by an ageing population and lower economic expectations.

Despite the stubborn optimism surrounding the convenience store revolution, concerns also linger about the availability of manpower to staff the ambitious expansion of ubiquitous 24-hour convenience stores, an industry which generates cash flow estimated in hundreds of billions of baht.

More migrant labour is being sought in Thailand including staff to man a growing number of 24-hour convenience stores as Thai staff cannot be found

Recent figures released by the Ministry of Labour indicate that employers are seeking to fill 81,900 positions, with an increasing reliance on foreign or migrant workers to cater to the day-to-day grocery and last-minute purchasing needs of Thai consumers.

At present, the major players in this vast industry are the CP Group with the internationally recognized 7-Eleven chain and brand.

CP All Public Company Limited, established in 1988 by the Charoen Pokphand Group, operates convenience store businesses in Thailand under the 7-Eleven trademark.

The company, granted a licence by 7-Eleven, Inc., USA, is the sole operator of 7-Eleven convenience stores in Thailand.

At the end of 2022, CP All boasted a total of 13,838 7-Eleven stores nationwide. Operations included 50% company-owned stores, 44% franchise stores, and 6% sub-area licence stores.

7-Eleven still on an expansion spree as it consolidates its position as the dominant player in the market targeting 15,000 stores in a growing market

The company has been on an expansion spree, with substantial investments in opening new branches, renovating existing stores, upgrading IT facilities, and establishing a new distribution centre. Revenues in 2019 before the pandemic shutdown were a staggering ฿361.03 billion but this will be dwarfed in 2023 with revenue for the first six months alone already confirmed at ฿454.32 billion.

The Chearavanont family, a Sino-Thai business family based in Bangkok and owners of the Charoen Pokphand conglomerate, plays a pivotal role in the success of CP All.

Forbes Asia ranked them as Asia’s fourth-wealthiest family in 2023, with a net worth of $36 billion.

Their diverse business interests span agriculture, telecommunications, marketing, distribution and logistics, international trading, petrochemicals, property and land development, crop integration, insurance, automotive, and pet foods.

7 Eleven expands business in Thailand, with the economy looking up, it embraces change

In 2023, challenging the dominance of 7-Eleven and the CP Group is Mr Charoen Sirivadhanabhakdi, one of Thailand’s wealthiest individuals with a staggering net worth of approximately $11.5 billion, who up to now has been associated with the alcohol industry.

Big player at the head of a rival conglomerate, a legend in Thai business circles is moving to provide competition through his company, Berli Jucker

Even within the glittering tapestry of Thailand’s business elite, for the last few decades, his name has stood out — Charoen Sirivadhanaphakdi is seen as a powerhouse of wealth and influence.

Born on May 2, 1944, and another Thai-Chinese tycoon, he has etched his legacy across diverse sectors, from the heady realms of the alcohol industry to the vast landscapes of real estate.

As the Chairman of the Board of Directors of Thai Beverage Company, Charoen orchestrates a symphony of success that resonates through the realms of business.

His prowess extends to the chairmanship of the Executive Board of TCC Land Asset World Company Limited and the Board of Directors of Berli Jucker Public Company Limited. A maestro in the alcohol industry, he is the proud owner of Beer Company Chang and its affiliated enterprises.

Beyond the boardrooms, Charoen wears multiple hats.

He is a member of the Thai-Chinese Cultural and Economic Association, a testament to his cultural and economic acumen. A steward of nature, he serves as an honorary advisor to the Foundation for the Conservation of Forests bordering 5 Provinces.

Charoen is an international Thai businessman with interests on all continents with extensive experience in retailing and marketing products globally

In the sporting arena, Charoen isn’t just a spectator; he’s a player. A former Senior Vice President of the Athletics Association of Thailand under the Royal Patronage, he exemplifies a commitment to both business and athleticism.

Yet, Charoen’s influence isn’t confined to Thai shores. He has boldly entered the global stage, notably as the main sponsor of Everton Football Club in the prestigious Premier League. The proprietorship of the Plaza Athenee Hotel in both Bangkok and the bustling heart of New York City further cements his international footprint.

Forbes, the beacon of wealth ranking, places Charoen Sirivadhanaphakdi in the upper echelons of affluence.

With a staggering net worth of $11.5 billion or ฿420 billion, he claims the throne as Thailand’s second-richest individual. In the global wealth race, he proudly holds the 87th spot.

Berli Jucker is both a manufacturing and distribution firm and is to be the vehicle for this foray into the business of convenience store retailing.

Drinks giant Thai Beverage to resume expansion with Singapore IPO for ASEAN regional beer operation

Richest man in Thailand calls for less time spent at school and a Thai education revolution for a new era

A politically incorrect economic success: Thailand is home to some of the world’s richest people

The firm already has access to tens of thousands of stand-alone local stores in Thailand while models in the United Kingdom and the United States suggest that such an approach if properly executed and financed can prove successful if well-trained and financed local partners are also found.

Strategy to combine stand-alone shops into a network

At length, the tycoon envisions a convenience store empire involving the transformation of 30,000 local shops into a branded convenience store network under his business model by 2027.

Charoen’s innovative approach includes providing logistics, marketing, and data management through his company, Berli Jucker.

In return, small stores commit to sourcing a minimum inventory from his conglomerate, which includes Big C Retail and Thai Beverage. This strategy effectively converts standalone shops into part of a nationwide and extensive convenience store network.

Mass transit magnate is also eyeing the growth market of convenience store profit in conjunction with the powerful Chirathivat family in retailing

Joining the retail revolution are other prominent figures in Thailand’s business elite, such as Keeree Kanjanapas, a mass transit magnate, and the Chirathivat family, renowned for their fortune amassed through department stores and shopping malls globally.

However, these aspirations face a formidable opponent in the form of CP All, the operator, in 2023, of more than 14,000 7-Eleven outlets, constituting nearly three-quarters of the country’s total number of convenience stores.

This competitive landscape unfolds against a backdrop of bullish expectations for the sector.

Prime Minister Srettha Thavisin’s economic stimulus plan, injecting approximately ฿560 billion ($16 billion) to revitalise the economy, coincides with this retail revolution. Anticipation of a rebound in tourism further fuels growth predictions.

The heart of this retail revolution lies in the surging popularity of convenience stores across Bangkok and major cities.

Success of the CP Group and its 7-Eleven chain in Thailand is phenomenal, the expanding chain will continue to be a tough competitor to go up against

These establishments serve as one-stop shops for a range of products, from ready meals to essential services like bill payments. The sector is poised for a 5.4% expansion in 2023, following an 18% surge in 2022 driven by the easing of Covid-19 restrictions, as per Euromonitor International.

Bank of Ayudhya projects a 5.5% annual growth until 2025, with food and beverages contributing to over two-thirds of convenience store revenue.

Despite this promising outlook, not all ventures are smooth sailing.

Mr Charoen, despite early successes with his mom-and-pop expansion, faced setbacks with the postponement of Big C Retail’s IPO, aiming to raise $1 billion, citing unfavourable investment conditions.

Similarly, the Chirathivat family, another extremely wealthy Thai family who just this month, came to worldwide prominence after taking over the Selfridges Department Store in London with high-profile stores in Ireland, the Netherlands, Germany and Austria, in a deal valued at over $5 billion, making them the owners of the largest European luxury store network, are also part of this race.

The family is Thailand’s fourth-richest and runs Thailand’s hugely successful Central Group of high-end department stores and shopping centres.

Central Group’s Family Mart reevaluating its strategy after being hit by the pandemic and whittling its store network down from 900 to 400 in 2023

Notwithstanding this, they are also operators of the local franchise of Family Mart, which is reevaluating its strategy due to pandemic-related challenges in tourist destinations. The franchise, which once boasted 900 stores in 2020, dwindled to about 400 by March 2023.

In an attempt to rejuvenate its brand, Central Retail announced the shift from Family Mart to Tops Daily in August.

Their partner and player in this billionaire race is Mr Keeree, an entrepreneur with interests in transportation, finance, and consumer products.

His company, BTS Group Holdings, introduced Turtle convenience stores in 2023 on prime platforms of Bangkok’s elevated rail system, capitalising on its extensive reach.

However, all these ambitions face a formidable challenge from CP All’s expansive plans.

Jiraphan Thongtan, Head of Investor Relations at CP All, revealed investments of up to ฿13 billion for 2023, aiming to open at least 700 more 7-Eleven stores.

CP All’s dominance, especially with expectations of increased consumer spending and a tourism rebound, positions them as the formidable leader in this retail race.

Join the Thai News forum, follow Thai Examiner on Facebook here

Receive all our stories as they come out on Telegram here

Follow Thai Examiner here

Further reading:

Richest man in Thailand says COVID-19 is like a World War, the kingdom could end up a big loser

Drinks giant Thai Beverage to resume expansion with Singapore IPO for Asean regional beer operation

7 Eleven expands business in Thailand, with the economy looking up, it embraces change