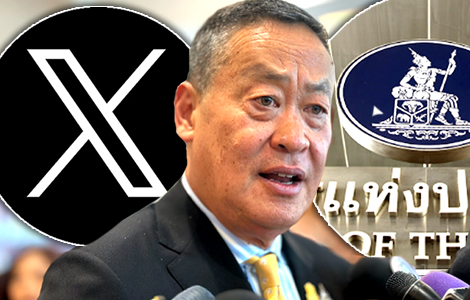

Economic turmoil online: PM’s second attack on Bank of Thailand raises bond concerns. Prime Minister Srettha Thavisin launched a scathing attack on the Bank of Thailand’s interest rate policy for the second time this week. With concerns over bond market stability, the PM’s clash with the central bank, at the same time, puts the spotlight on underlying economic challenges and structural issues.

On Sunday, the Prime Minister took to X, formerly Twitter to lash out at the central banks’ interest rate policy. On Monday, various advisers and key ministers followed suit. It comes ahead of the February 7th meeting of the Bank of Thailand’s Monetary Policy Committee. This is expected to keep rates as they are. Significantly, it is the second time in a week the PM has taken issue with the central bank’s policy. Last week, he also used his appearance in parliament at the start of the budget debate to attack the independent institution responsible for Thailand’s financial stability. It appears the pressure is mounting on the Bank of Thailand while Mr Srettha’s Deputy Minister of Finance Julapun Amornvivat, on Monday, also raised concerns about the country’s bond market.

As Thailand’s economy hunkers down for another challenging year of limited growth prospects with significant underlying problems and structural challenges, the government leader finds himself increasingly at war with the country’s central bank boss.

At length, Thailand is only projecting growth of 3.2% in 2024. At the same time, the Bank of Thailand has embarked on a programme to rein in runaway private sector debt.

Undoubtedly, Thailand has fallen into the ‘middle-income trap’ and it will take long-term thinking and structural reform to remedy its chronic problems

Undoubtedly, the country’s economy built in the 1960s, 1970s and 1980s has failed to rise to a high-income one. The reasons are many.

In addition to an inadequate education system, chronic inequality and its rapidly ageing population retarding growth, the kingdom has fallen into the feared ‘middle-income trap’ like others worldwide.

PM takes aim at the Bank of Thailand over interest rates despite Thailand’s lower borrowing costs

The kingdom’s coup d’états in 2006 and 2014 turned it into a pariah on the international stage.

It will take another decade of the policies now being pursued by this government to build back international investor confidence. All this, notwithstanding the troubled world order we bear witness to in 2024.

No more piggybacking the Chinese economy. Pandemic sparked a cleanout of uncompetitive firms and manufacturing. Lack of investment consolidated the loss

The kingdom’s two-decade piggyback on Chinese economic growth is over. It ended in 2017 and 2018.

Afterwards, the pandemic severely damaged the country’s slowly recovering foreign tourism industry.

Much of this was self-harm inflicted by the heavy-handed response by the previous government.

Most significantly, that crisis mothballed a growing portion of the country’s old manufacturing and export base.

It needed investment and confidence, what it got was empty order books and a closed economy in 2020 and 2021.

Meanwhile, other more dynamic Southeast Asian economies continue to steal its lunch.

At length, this has created problems which will require structural reform and patience to address.

In the meantime, there are concerns about the country’s bond market as well as commercial bank profitability.

Bank of Thailand focused on preserving financial stability. In 2024, it is tackling runaway household and private sector debt rather than short-term GDP

Regardless, this is leading the Bank of Thailand, tasked with preserving financial stability to evaluate its low interest rate policy.

The central bank, unlike the current government, is less interested in short-term GDP growth figures.

Bank of Thailand to tackle household debt in new plan from 2024 which will see higher standards

While most analysts predict no change in the policy rate of 2.5%, over half the US level, at the next Monetary Policy Committee meeting, there are murmurs about an increase.

Overall, the bank is trying to rein in private-sector debt. Moreover, higher interest rates allow banks more scope for profits while attracting deposits

Nevertheless, on Sunday, Prime Minister Srettha Thavisin took to social media to attack the Bank of Thailand (BoT).

In short, he said elevated interest rates were damaging the economy while inflation was at a 34-month low.

The controversial statement has ignited a debate over monetary policy and its impact on the country’s economic performance.

Blistering attack on the Bank of Thailand by the PM followed on Monday by officials including top ministers. High food prices blamed on borrowing costs

Since Mr Srettha came to power in September both the PM and his spokespeople have emphasised the importance of ‘quick wins’.

In contrast, Thailand’s economic problems demand long-term and structural change. This is the crux of the conflict between the PM and the central bank.

On Sunday night, PM Srettha overtly criticised the BoT on X (formerly Twitter). Certainly, he blamed the central bank for the economic challenges faced by the country.

He argued the BoT’s decision in September to raise its policy rate was detrimental to the poor. In addition, it severely impacted small to medium-sized business concerns.

In the post, the Prime Minister claimed that the central bank’s move was particularly misguided.

At the same time, there have been months of negative inflation. Thailand’s inflation rate for December, for instance, was at a 34-month low of 0.83%.

‘The rise did not benefit the economy and adversely affected low-income earners and SMEs,’ said PM Srettha in his social media broadside.

Coming a week after Mr Sretha again criticised the bank, this week the criticism is even stronger and from other government sources. It signifies a crisis

The accusation caught many by surprise.

It has prompted questions about the relationship between fiscal and monetary policies in Thailand. Notwithstanding that, it signifies an increasingly fractious relationship between Bank of Thailand boss Sethaput Suthiwartnarueput and the PM.

On Monday morning, during a visit to the Royal Thai Police Office, Prime Minister Srettha reiterated his disagreement with the BoT’s approach to interest rates. He made it clear that he would discuss the matter directly with BoT Governor Mr Sethaput.

‘I don’t agree with the BoT’s interest rate hike, and I have made my position clear,’ asserted PM Srettha.

Backing the Prime Minister’s stance, was his chief adviser, Kittiratt Na-Ranong. In brief, the official emphasised the need for substantial and swift interest rate reduction to address economic challenges.

Kittiratt pointed out that lowering interest rates would align with government policy. Additionally, it would provide relief to various sectors, especially those struggling due to recent rate hikes.

Interest rates are the lowest in Southeast Asia, less than half the US level. Nonetheless, they are a recent high for the ailing Thai economy, drunk on debt

The BoT’s Monetary Policy Committee (MPC) has raised the policy rate eight times since August 2022. Eventually, it reached 2.50% in September 2023.

The rates are the lowest in Southeast Asia and less than half the rates in the United States.

Thai economy is stable but is being strangled by personal debt. Fixing it could see pain before any gain

The rate hikes were initiated to control inflation, which soared to 8% in 2022, marking its fastest pace.

However, in a meeting on November 29, 2023, the MPC maintained the rate at 2.50%. The committee cited its suitability for economic fundamentals and the ongoing recovery.

Phumitham Wechayachai, Deputy Prime Minister and Minister of Commerce, on Monday, responded to the Prime Minister’s concerns.

Significantly, he ordered an urgent meeting on provincial commerce. The focus is on mitigating the impact of higher borrowing costs on agricultural product prices.

After that, PM Srettha’s top adviser, Kittiratt Na-Ranong, expressed concerns about the impact of rising interest rates on commercial banks’ profits.

He noted higher interest rates provided opportunities for banks to increase revenues, putting a burden on consumers, especially low-income groups.

‘Rising interest rates were opportunities for commercial banks to raise revenue because loan interest rates increased faster than deposit rates,’ said Mr Kittiratt.

Pressure is being brought to bear on the independent Bank of Thailand’s equally independent Monetary Policy Committee. It smacks a little of desperation

Adviser Kittiratt emphasised that the government agencies would closely monitor the BoT’s monetary policy committee’s decision. Of course, this will come at the upcoming meeting on February 7.

The open nature of the pressure now being applied tends to undermine confidence and smacks of desperation, in any case, frustration.

Simultaneously, on Monday, the Ministry of Finance, through Deputy Minister of Finance Julapun Amornvivat, admitted his ministry lacked the authority to order the BoT to reduce interest rates. However, he pointed to the possibility of creating a fund to support problematic bonds.

This is significant and raises concerns about the possibility of high-profile bond defaults.

Bond financing has over the last decade replaced bank borrowing as an option for large Thai firms and enterprises.

Questions have been raised in the last year with the banking crisis in China over this type of funding.

However, the timing and necessity of such measures remain unclear.

Deputy Minister of Finance Julapun Amornvivat, at length, vowed the government will, in any event, speed up the budget disbursement to boost the economy

At the same time, Deputy Finance Minister Julapun Amornvivat acknowledged concerns about the current economic situation.

He highlighted the ministry’s commitment to using fiscal tools, including pushing the annual budget swiftly. That will stimulate economic circulation and support the people during economic challenges.

The Ministry of Commerce reported a decrease in general inflation in December 2023, reaching 0.83%.

In summary, this was compared to the same period the previous year. However, concerns about negative inflation for several consecutive months and potential deflation are looming.

‘We were of the opinion that the recent policy interest rate increase of the Monetary Policy Committee (MPC) of the Bank of Thailand (BoT) was too fast and too strong, affecting the current economic situation,’ asserted Deputy Finance Minister Julapun.

As the economic debate intensifies, all eyes are on the BoT’s upcoming monetary policy committee meeting on February 7.

Prime Minister Srettha’s call for urgent measures to address the impact on agricultural product prices indicates a broader concern.

Finding the right balance between fiscal and monetary policy appears to have become a short-term concern for Thai ministers as they navigate uncertain economic waters.

However, the economic imperative is how to tackle the country’s long-term structural problems at the root of the malaise. Obviously, there will be no ‘quick wins’ there.

Join the Thai News forum, follow Thai Examiner on Facebook here

Receive all our stories as they come out on Telegram here

Follow Thai Examiner here

Further reading:

PM takes aim at the Bank of Thailand over interest rates despite Thailand’s lower borrowing costs

Steady as she goes growth and economic stability driven by a growth in US exports is all good news

Economy at crossroads: World Bank calls for structural reform to avert two decades of low growth

Fragile, weak economy sees central bank holding interest rates and reducing 2023 growth to 2.4%

Srettha’s crisis is not just an economic one, it is a ‘3D debt crisis’ that is strangling GDP growth

Zombie Thai firms holding back economic growth as they struggle just to pay interest on bank debt

Incoherent government economic policy clashes with Bank of Thailand’s efforts to rein in debt

Economy is in troubled waters with fears for both exports and foreign tourism as 2023 winds down

Thailand faces an economic future of low growth despite Srettha’s plans because of a darker world