Bank of Thailand holds interest rates at 2.5%. It projects 2.6% growth in 2024 with the economy gaining momentum. However, the Monetary Policy Committee again made it clear that Thailand faces severe structural challenges. The economy is not well placed to take advantage of any future global upturn. At the same time, PM Srettha this week pushed a stimulus package for the real estate sector despite the credit crunch and a market led by Russian and Chinese buyers.

On Saturday, Prime Minister Srettha Thavisin underlined the importance of homeownership for the Thai economy. It came in a week when his government announced property sector stimulus measures. This is aimed at boosting a depressed property market despite a flurry of Chinese and Russian buyers from abroad. The decision came the day before the Monetary Policy Committee of the Bank of Thailand held interest rates at 2.5%, certainly a rebuff to Mr Srettha. The PM and key aides have waged an aggressive campaign against the Bank of Thailand this year. Undoubtedly, this has undermined confidence in the management of the economy. In its statement, the central bank said it was confident the economy would grow this year with increased momentum. However, it again referred to Thailand’s severe structural impediments saying that even with a recovery of the world economy, Thailand was, at this time, limited in its prospects.

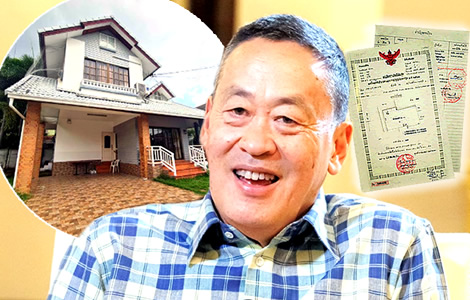

Prime Minister Srettha Thavisin has vowed to implement measures aimed at stimulating the real estate sector without necessarily favouring big business over the general public.

The Prime Minister’s approach comes amid criticism that previous government measures to stimulate real estate primarily benefited big corporations rather than ordinary citizens.

It comes after Mr Srettha, last week, at a business conference in Bangkok, ruled out land ownership rights for foreign residents.

PM Srettha Thavisin recently vowed that his government would not try to open up land or home ownership to foreigners unlike General Prayut’s ministry

Previously, this had been mooted by the government of General Prayut Chan Ocha. Condos are conditionally allowed to be sold to foreigners in Thailand.

Significantly, a lot of recent buyers in Bangkok and Phuket are of Chinese and Russian origin. In the meantime, extended long-term leases and companies with nominee shareholders are practices still being pursued by some of these buyers, especially in Phuket and Pattaya.

The latter is now subject to an official crackdown which has seen multiple police raids in the last few weeks.

The previous government’s proposal was part of a specialist visa programme to attract high earners to Thailand. This aspect of the plan was subsequently abandoned in the face of public opposition. That was in November 2022.

The PM said under his government there would be no concessions to allow foreigners to buy homes in the kingdom.

Thai property market is still suffering from a glut and oversupply despite demand from Chinese and Russian buyers. Liquidity and cash are in short supply

However, the property market in Thailand is currently in a period of oversupply. Undoubtedly, the main reason for this is a credit squeeze by the central bank.

Beginning in January 2024, the bank has tightened lending criteria. In brief, the goal is to rein in a spiral of household debt.

Nevertheless, on Tuesday, with the government’s approach of aiming for ‘quick wins’, a new round of property stimulus measures was approved by the cabinet.

At length, this includes a cut in transfer fees. In addition, ministers raised the threshold for condo and home sales from under ฿3 million to ฿7 million to allow transactions to benefit from these reduced charges.

Property market glut sees minister’s call for supports in the face of the central bank’s ongoing credit crunch

Land for foreign high flyers plan to be axed by cabinet as new 10-year visa draws a pretty mild response

Certainly, the goal is to make it easier for property purchasers to take the plunge. However, there are other factors right now preventing this.

Unquestionably also, there is a tightness of liquidity in Thailand’s economy right now caused by capital outflows. In addition, the Bank of Thailand has tightened lending criteria.

In turn, there is also a lack of growth in the economy which consequently has impeded income levels. Certainly, elevated interest rates are a secondary factor.

PM on Saturday touted home ownership as a form of savings. A potential stabilising factor in the economy provided, of course, property prices are realistic

However, the PM emphasised that home ownership was a form of savings.

Additionally, this can also contribute to financial stability in the longer term. This is of course provided house prices are justified.

In short, property ownership is intrinsically wedded to the economy.

Mr Srettha was commenting after the Monetary Policy Committee of the Bank of Thailand held interest rates on Wednesday.

This came despite a brutal campaign targeting the central bank from government ministers and associates in the previous period.

It comes with a growing consensus among analysts that interest rate falls will come this year. The best guess right now is a 25 basis points drop in June and similarly in September.

At length, the central bank maintains that economic momentum in Thailand is growing albeit at a slow rate.

The report from the Monetary Policy Committee cited deep-rooted structural problems as the key impediment to economic growth. In particular, it referred to Thailand’s export economy losing competitiveness.

Thailand needs a radical new economic plan of its own, not a one-size-fits-all prescription from world economic agencies. The country’s problems are unique

In turn, this has resulted in an underutilised manufacturing base.

Meanwhile, there is an oversupply of capacity. All this commences with heavily indebted firms and an ageing, undereducated workforce to explain the country’s lack of growth.

Thailand needs a radical 30-year economic development programme. At the same time, as a country that has become an aged society that is relatively poor, it needs an alternative economic development strategy.

The one plan fits all schemes from the International Monetary Fund (IMF) and World Bank playbook will not suffice.

Indeed, there are significant question marks about these strategies not only in mid-level income countries such as Thailand but also across the developed world.

For instance, there are cultural as well as structural issues that are impeding Thailand’s ability to grow economically.

For example the endemic strength of the Thai language and lack of English proficiency.

Thailand not ready to benefit from a global pickup

On Wednesday, the central bank posited that even with a pickup in the world economy, Thailand’s growth prospects remain limited.

However, on Saturday, Mr Srettha continued to emphasise the importance of stimulating the real estate sector to benefit the economy.

He explained that when a person purchases a home, it boosts various industries such as carpets, glass, doors, sanitary ware, air conditioners, and furniture.

‘This has resulted in many industries receiving positive results and having access to housing. It is considered a form of saving,’ he said. He also underlined that people building their own homes should be entitled to tax deductions.

On interest rates, the PM acknowledged the Monetary Policy Committee’s (MPC) decision to maintain the policy rate at 2.5%.

Lower interest rates will not cause the baht to weaken, argues the Prime Minister. Similarly, he argued that it would boost exports and see more revenue

However, he expressed his belief that reducing the rate would have more positive than negative economic side effects.

He highlighted the impact of interest rates on the economy, particularly in terms of exports and tourism.

‘Today, I’m not under any pressure, and when the results come out, let the people decide for themselves whether there should be a reduction or not,’ Srettha said.

He declared that academics presently support a reduction in interest rates. In turn, he linked this to the beneficial impact it would have on Thai exports.

Meanwhile, the PM argues that lower interest rates would not weaken the baht. At the same time, he said that they would benefit exports.

‘It does not cause the baht to weaken. It makes Thai exports better. We just export 60% of GDP and tourism another 20%. $1 can be exchanged for ฿36, ฿37, ฿38, giving us more money to spend in the country.’

Tourism is a huge boost to the economy. It benefits all kinds from big business to small traders, explained PM. Expected lower rates to help conditions

The Prime Minister emphasised the importance of tourism, noting that it supports not only big hotels but also smaller businesses and local industries.

He believes that this kind of economic growth is well understood, suggesting that reducing interest rates could foster positive economic conditions.

In the meantime, economic research centres such as the SCB Economic Intelligence Centre (EIC) and Krungthai COMPASS issued reports. At length, they indicate that there is still potential for a reduction in interest rates this year.

The analysts expect the central bank to reduce interest rates in the next two meetings in June and August.

They concluded that it would alleviate the burden on debtors and support economic growth.

However, it is certainly not guaranteed.

Fears the central bank will not lower borrowing costs before the Federal Reserve in the US. At this time, the likelihood and timeframe for this has receded

A more powerful US economy is leading to speculation that the Federal Reserve may not lower US interest rates as quickly as thought.

At the same time, the differential between US interest rates at 5.25% to 5.75% and higher bond returns is being discounted by many analysts. Nonetheless, the Thai government is planning a ballooning fiscal deficit in the 2025 budget.

Some analysts suggest that the central bank will not lower interest rates until after a US move.

Furthermore, there is also unease at the government’s plans to proceed with its controversial Digital Wallet plan in the last quarter.

Funded in three parts, from the 2024 budget, 2025 budget and support from the Bank for Agriculture and Agricultural Cooperatives (BAAC), the scheme has already run into further legal uncertainty.

Prime Minister Srettha Thavisin, for instance, was forced to seek advice again this week from the Council of State.

Digital Wallet scheme is controversial and a worry

In short, this concerns the use of the bank’s resources to fund the government scheme. Critics suggest it has all the hallmarks of the rice-pledging scheme introduced in late 2011.

It was a disaster burning taxpayers to the tune of at least ฿500 billion.

Formerly, this saw officials and cabinet ministers jailed after the 2014 coup d’état. This was the signature policy of the last Pheu Thai-led government.

Digital Wallet plan blown out of the water by corruption body on Tuesday warning of illegality

The MPC’s decision this week to maintain the policy interest rate at 2.5% was not unanimous. Two out of seven committee members voted to cut the rate by 0.25%.

This split decision reflects the committee’s differing perspectives on the state of the Thai economy and the effectiveness of monetary policy in addressing structural challenges.

Secretary of the Bank of Thailand’s Monetary Policy Committee (MPC ), Piti Disyatat commented afterwards. He highlighted that the Thai economy is projected to grow by 2.6% this year. This was viewed positively by the committee.

Growth of 2.6% seen in 2024 with GDP momentum gaining as the bank’s Monetary Policy Committee dismissed negative inflation concerns

It is particularly encouraging given the severe structural problems the country is dealing with. It is ahead of the 1.9% seen last year and the 1.7% recorded in the last quarter of 2023.

The economy is expected to improve quarter-on-quarter throughout the year. The central bank foresees growth improving in 2025 with an expansion rate of 3%.

The bank dismissed the negative inflation figures. The monetary policy panel pointed to the government’s energy subsidies, particularly in respect of electricity. If these were taken into account, this would not be so.

Mr Piti, however, mentioned that the bank has taken into account the government’s recently announced stimulus measures. For example, the property incentives and digital wallet scheme, in assessing the economy’s growth potential.

However, the governor cautioned about various uncertainties, including export recovery, government budget disbursement, and the same fiscal stimulus measures. He acknowledged the importance of closely monitoring these factors as the economy evolves.

2024 economy driven by consumers and the government

Analysts increasingly see the economy being driven by consumer expenditure and public investment.

The former is driven by foreign tourism and the latter by the government budget. All gains in momentum are set to peak in the last quarter of 2024.

Experts at Maybank Securities Thailand and Asia Plus Securities weighed in on the situation. They noted that the current interest rate aligns with market consensus and provides support for economic stability.

They expect economic growth in the coming years. This would be bolstered by potential government stimulus measures, robust export performance, and increased state infrastructure projects.

Monetary Policy Committee made plain again the severe structural problems that are impeding growth within the Thai economy. These are not being tackled

Economists are predicting a rate cut from the Bank of Thailand before mid-year. Primarily, due to easing inflationary pressures and a slower-than-expected economic recovery.

Nonetheless, this ignores the multitude of severe challenges facing Thailand. Even as the economy moves forward supported by foreign tourism, it faces an array of problems.

Massive private sector debt, its ageing population, rampant corruption, its increasingly obsolete manufacturing sector and poor education systems are, in effect, directing the country’s economic course. In the midst of all this, there is also the growing fear of geopolitical conflict and even the potential for war in Asia.

Thailand needs a radical change in direction if it is to cure its problems. Certainly, the kingdom can be regarded economically, for now, as the sick man of Asia.

Join the Thai News forum, follow Thai Examiner on Facebook here

Receive all our stories as they come out on Telegram here

Follow Thai Examiner here

Further reading:

Economy unlikely to grow in first quarter as Thai manufacturing crumbles. Hard choices ahead

New Finance Minister expected in April as economic malaise deepens with downgrades in GDP growth

Digital Wallet plan blown out of the water by corruption body on Tuesday warning of illegality

Economy is in troubled waters with fears for both exports and foreign tourism as 2023 winds down

Thailand faces an economic future of low growth despite Srettha’s plans because of a darker world

Another dip for the baht or are economic danger signals flashing for both Thailand and the world?

Bank of Thailand boss appears critical of the new government’s policy initiatives on the economy