The government’s key economics minister underlined its green credentials as he put the environment at the centre of agricultural, tourism and industrial policy in explaining what he sees as the way forward for the kingdom in the post-COVID-19 world. He said the cabinet is still considering proposals to attract up to 1 million wealthy and skilled foreigners to come and live in Thailand as a replacement for the trillions of baht lost with the demise of the country’s old fashioned foreign tourism concept based on high volume and low spending visitors.

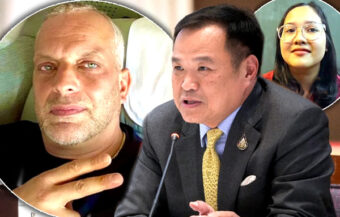

Thailand’s Deputy Prime Minister Supattanapong Punmeechaow, on Friday, doubled down on government rhetoric and policies which talk of transforming Thailand into an advanced, eco-friendly economy fighting for social justice. It is coming at a time when poverty rates and devastation from the COVID-19 crisis brought about by the government’s response to the pandemic is spiralling into uncharted territory. Minster Supattanapong again emphasised the government’s determination to move away from mass-market tourism towards a new ‘high quality’ and environmentally friendly industry where fewer foreign tourists spend more. He promised that the government would do something to help indebted households which have run up record levels of debt. The speech comes amid signs of a gathering world economic storm as western countries count the cost of pandemic supports from the public purse and rising tensions between Thailand’s two main customers, the USA and China.

Thailand’s economy is facing a plethora of other challenges in addition to being on course for the worst year ever recorded for the kingdom’s tourism industry.

This was alluded to on Friday by Deputy Prime Minister Supattanapong Punmeechaow when he warned that rising energy prices were being watched very closely by the government.

His comments followed a similar instruction to government ministers from Prime Minister Prayut Chan ocha this week.

‘Rising energy costs is a new challenge and the government has been trying to reduce its impacts on people,’ Mr Supattanapong affirmed.

Prime Minister orders his economic team to carefully monitor impact of rising world energy prices

The Prime Minister issued a directive to the Ministry of Energy, on Sunday last, the 3rd of October, to monitor the situation as the government considers extending measures to subsidise electricity costs for the most vulnerable until September 2022 as part of a fiscal stimulus programme to boost the economy and assist the less well off.

However, Minister Supattanapong on Friday emphasised the eco-friendly credentials and a new economic policy direction by the government when he outlined a target to reduce energy consumption across the board within the kingdom by 30% over the next twenty-five years up to 2037.

The Deputy Prime Minister made clear that Thailand would not be going back to a mass market, high volume form of foreign tourism even after the pandemic and would focus instead on protecting its environment and ecosystem.

‘Instead of relying on 40 million tourists to generate 2 trillion baht in revenue, we will turn to focus on quality tourists who can spend more,’ the government’s economics czar told attendees at a Bangkok Post organised seminar themed ‘Resilient Thailand: Ways to Bounce Back’.

‘This will be good for the country’s environment and natural resources,’ he declared.

Campaign of boosted financial stimulus aiming to refloat the Thai economy by boosting consumption

The minister made his comments as the Thai government is embarking on a campaign of domestic fiscal stimulus spending to boost the economy even as there are warning signals worldwide that growing public sector debt and consumer demand may soon lead to rising interest rates and inflation.

It comes as consumer sentiment in Thailand ticked up in September with an easing of COVID-19 restrictions although many measures still remain in place.

The current global economic situation is already leading to a strengthening of the US dollar as analysts believe that the Federal Reserve will have to move, in short order, to raise interest rates and bring an end to a long-running era of easy money in the United States even as politicians in Washington DC moved on Thursday to pass legislation aimed at lifting the debt ceiling to facilitate further borrowing by the US Federal government.

This is coming as western governments, with far high levels of debt to GDP ratios than Thailand, in part due to generous pandemic supports to their populations and the economy, are now facing the prospect of quickly tightening economic policy to stave off inflationary pressures as consumer demand starts to boom.

Weakening baht will create inflationary pressures but could well be a boon for tourism and exports

This has contributed to a weakening baht which, while it may create inflationary pressures which will again hurt the less well off in the kingdom, will also stimulate demand for Thailand’s exports and potentially for inward tourism if the kingdom properly opens its borders and removes its burdensome restrictions on entry.

Last week, the Bank of Thailand predicted that the Thai currency would remain volatile and had the potential to depreciate quickly.

On Friday, it was quoted at ฿33.84 to the US dollar and compared to the last day of 2020 when it dipped to ฿29.80 against the US currency, this represents a 13.5% drop in value in 2021, so far.

The economy is facing many downside risks in the fourth quarter including anaemic domestic consumption and disappointing foreign tourist arrivals.

However, based on export gains and government stimulus activities, most forecasters, including the Bank of Thailand, are projecting marginal growth for the year of between 0.7% and 1.2%.

Revolution in Thai agriculture with a shift to monocultural farming to help reduce climate change

Mr Supattanapong, on Friday, spoke of a revolution in Thai agriculture and a shift to monocultural farming which he suggested would help in reducing the kingdom’s CO2 emissions and to Thailand playing its part in helping to reduce climate change with fears of increased world temperatures.

The Deputy Prime Minister also referred to the government’s scheme to attract up to 1 million well to do or highly skilled foreigners to come and live in Thailand to boost investment in the country’s and its tax base into the future.

Limited measures to allow wealthy migrant foreigners to buy homes still being considered by the cabinet

He suggested that the cabinet was still considering measures to support this programme amid a heated debate on the prospect of allowing foreigners to own land and property in Thailand.

It is understood that the government is considering very limited steps in this direction as officials ponder the situation with evolving feedback.

One proposal is that the 49% ownership rule in respect of foreigners and condominium developments be raised.

The second and most significant is that it would be permissible for foreigners who qualify under the strict terms of such a scheme, be allowed to purchase a home or land within a specified price range of ฿10 million to ฿15 million, for personal use only and appropriate to the sort of person that the government is seeking to attract to the country.

The third proposal is to extend the terms by which foreigners can legally enjoy long lease concessions in Thailand by allowing long term lease term extensions of 40 years after an initial 50 year period giving a combined 90-year lease facility.

Shift from mass-market tourism again emphasised by the Deputy PM to protect the kingdom’s environment

Speaking to the Bangkok audience on Friday, Mr Supattanapong also categorised this initiative as a potential replacement for mass-market foreign tourism in the future.

He referred to the Eastern Economic Corridor flagship project and said that the government was laying down an ‘ecosystem’ for future investment in the Thai economy and sustainable growth in such areas as medical instrument manufacturing, electrical cars and smart electronics.

He also suggested that Huawei Technologies (Thailand), the Thai arm of the controversial Chinese technological giant, was playing a key role in the digital infrastructure of the Eastern Economic Corridor scheme.

Government is now working in partnership with Chinese firm Huawei on digital infrastructure for the Eastern Economic Corridor despite US concerns

In October last year, the former US ambassador, Michael de Sombre, expressed concern about the partnership between the Thai government and the Chinese firm on the project following claims by US intelligence agencies that Huawei was closely linked and compromised by Chinese intelligence services.

Last year, Mr Abel Deng, the CEO of Huawei in Thailand, while announcing a ฿700 million data processing development within the EEC, expressed confidence in the project’s future as a digital hub within the ASEAN community.

‘We are confident of Thailand’s potential to become Asean’s first digital hub, and this will help the country’s digital economy contribute to 30% of the GDP by 2030,’ he said at that time.

Thai ministers set out ambitious agenda to make the kingdom the dominant digital player in ASEAN

Mr Deng was again a keynote speaker at this year’s Bangkok Post seminar.

‘As for the development of digital infrastructure under the EEC scheme, the CEO of Huawei Technologies (Thailand) will explain the matter because Huawei has attached importance to Thailand’s telecom and digital infrastructure development,’ said Minister Supattanapong on Friday as he deferred to the executive of the Chinese firm on the subject.

US-China tensions have begun to again reassert themselves in the last week with new trade issues and news of the US military assisting Taiwanese forces

There are growing signs of renewed hostility and conflict between the United States and China on trade with a US negotiator recently accusing China of reneging on a 2020 agreement made with the Trump administration in addition to dangerous tensions between the two superpowers over Taiwan with revelations, just this week, that US armed forces are already stationed on Taiwan training the military on the breakaway island which claims to be independent of China.

US Ambassador resigns as Biden Presidency starts with growing tensions with China over Taiwan

Only 15 states currently recognise Taiwan as an independent republic with Thailand recognising only Beijing as the ‘one China’ since 1975 followed by the United States in 1979.

This is despite continued and indeed renewed US military and diplomatic support under the Trump presidency which appears to have continued into the Biden era.

There is heightened speculation that hostilities over the island in the South China Sea may occur at any time up to 2025 with senior ministers in the Taiwanese government increasingly underlining the serious nature of the threat.

Global supply chain problems emerging and rising shipping costs as the world economy cranks up

The present uncertainty is added to by global supply chain problems as well as renewed concern about inflation with rising oil and shipping costs as the world economy cranks up as the COVID-19 threat appears to be receding slowly.

Despite these concerns, investors in Thailand remain bullish and are more concerned about advancing the country’s vaccine rollout and the effective reopening of its borders to international foreign tourism.

Inflation is another ball that Thai planners will have to watch and juggle going into a highly uncertain 2022

Inflation appears to be gaining ground and is on target to be between 1.4% and 1.8% in the final three months of the year.

The rate hit 1.68% in September just after a marginal decline in August aided by government stimulus and support measures to ease the pain of the ongoing lockdown measures introduced in June and July.

For the third quarter of 2021, the rate was 2.36% from last year amid a consensus that it is something that will need to be watched.

Thailand received a fillip this week when S&P Global Ratings (S&P) reaffirmed the kingdom’s Sovereign BBB+ rating and kept its stable outlook guidance for the Thai economy going forward.

Household debt to be tackled says Minster Supattanapong to lighten the burden on families

Concluding his remarks on Friday, the Deputy Prime Minister referred to Thailand’s chronic problems with household debt, an issue the Bank of Thailand has listed as a priority to be tackled and which most senior economists admit is impairing any prospect of boosting domestic consumption.

Minister Supattanapong talked about the government’s commitment to fighting social injustice and suggested that ways would be found to lighten the burden on such households.

‘Many said household debts account for 80% to 90% of GDP. But this is a result of a long accumulation of figures. GDP figures have now declined because of Covid-19. But we are looking at ways to ensure justice,’ he stated.

This year, Kasikorn Research Centre, the research arm of the leading Thai bank, reported that household debt in Thailand in the first quarter had mushroomed to ฿14.13 trillion or 90.5% of GDP.

According to the Bank of Thailand, it is the highest level in 18 years but the environment, right now, is far less benign than it was in 2003.

This represented a rapid pace of growth from 84.9% from the last quarter of the year and highlights the desperation being felt by poorer Thai families under the strain of the current economy which a Tourism Council of Thailand survey last week revealed has seen 70% of households lose 40% of their income since the crisis began.

Join the Thai News forum, follow Thai Examiner on Facebook here

Receive all our stories as they come out on Telegram here

Follow Thai Examiner here

Further reading:

Another GDP contraction looms as Thailand tries to boost its economic fortunes by spending more

Government borrows more to bring the economy through an extended Covid 19 crisis with GDP flat

Officials switch to prioritising economic recovery as CCSA expected to agree a new Covid approach

Rising prospect of GDP contraction for 2021 may see government breach the legal public debt limit

Economic fears rising as Thailand faces a bigger crisis than 1997 with rising job losses and debt

Baht falling with confidence in Thailand waning as foreign tourism closure and virus drive funds out

Central bank to lower GDP growth forecast as its attention turns to private sector debt management

Loan bill passes but Thai economic prospects are not bright with a 1.8% 2021 GDP gain predicted

IMF urges government to loosen nation’s purse strings as finances tighten with the tax take down

Failure to pass the ฿500 billion borrowing decree could lead to the dissolution of parliament

Industry leaders and central bank all warn that foreign tourism must return to avoid a collapse

Fact – only 6,556 visitors arrived in Thailand last month compared to 3.95 million in December 2019

Desperate foreign tourism business concerns are clinging to straws as they try to survive the crisis

Challenge of the virus and closure to tourism leads to major long term changes in the Thai economy

Finance Minister says economy must pivot away from tourism with a switch to S-Curve industries

Strengthening baht predicted as investors bet on a reopening of Thailand to mass tourism in 2021

Thailand facing a credit crunch as 3rd virus wave craters the kingdom’s economic recovery plans

3rd virus wave now spells not just economic loss but financial danger as kingdom’s debt level rises

Still time to avoid lockdown says Health Minister as 3rd virus wave dwarfs all infections to date

Thai economy is still in reverse despite rising confidence and a virus threatening a 3rd wave

Reopening of Phuket still not officially approved although it is the ideal test for a broader move

Minister urged not to be afraid to borrow in 2021 as fears grow for a quick foreign tourism revival

Economy to rebound as the year progresses driven by exports and a return of mass foreign tourism

Door closing on quick foreign tourism return as economic recovery is delayed to the end of 2022

Fact – only 6,556 visitors arrived in Thailand last month compared to 3.95 million in December 2019

Desperate foreign tourism business concerns are clinging to straws as they try to survive the crisis

Finance Minister says economy must pivot away from tourism with a switch to S-Curve industries