Government measures, particularly in energy, led to the -0.44% November inflation or deflation, the lowest in 33 months. The silent clash over economic policies deepens, with potential repercussions on the fragile economy and what is for now, still a recovery.

On the face of it, record low inflation and fast-falling prices should be good news for the embattled government of Prime Minister Srettha Thavisin as confirmed by the latest economic data released this week. However, beneath the figures lies a disturbing trend and that is deflationary sentiment taking hold in the economy and the minds of the public. The situation is also poised to magnify divisions between the Prime Minister and the Bank of Thailand Governor Sethaput Suthiwartnarueput as well as elements within the cabinet who, above all, fear the return of runaway inflation which would decimate the country’s struggling manufacturing base.

The trend is not so surprising but the extent is. It comes with the latest economic data this week showing Thailand’s headline inflation has taken a nosedive, registering at -0.44% in November, marking its lowest point in 33 months.

This decline for a second consecutive month has been primarily attributed to lower energy prices, particularly for diesel and gasohol 91, driven by the government’s support measures. The current economic climate in Thailand remains fragile, with a slow and anaemic recovery, but lower inflation seems to be a silver lining amidst the challenges.

Policies since September played a role in the good news from the country’s inflation front with the cost of living pressure far lower than Western countries

Prime Minister Srettha Thavisin’s government has played a pivotal role in this decline in inflation. Since assuming office in September, the government has successfully implemented measures to reduce energy and electricity prices.

This reduction, in turn, has contributed significantly to the decrease in overall inflation. The government’s initiatives have proven effective in maintaining lower inflation rates compared to Western countries, particularly the United States and Europe.

However, a looming threat to this trend arises from the Office of the Energy Regulatory Commission’s proposal to increase the electricity tariff rate from ฿3.99 per kWh to ฿4.68 in the new year. This proposal, aimed at repaying a debt to the country’s electricity generation authority, may disrupt the downward trend in inflation if implemented.

Ministry of Commerce briefing into the factors and cost drivers in the current economy as recorded inflation keeps falling into negative territory

Poonpong Naiyanapakorn, Director-General of the Trade Policy and Strategy Office at the Ministry of Commerce, provided a comprehensive briefing on the country’s inflationary trends and pressures.

He highlighted that lower prices for electricity, diesel, and gasohol 91, along with reduced fares on electric trains, played a crucial role in the decline in headline inflation.

The prices of various goods, including pork, fresh chicken, and vegetable oil, also witnessed a decrease in November 2023 compared to the same period in 2022. Mr Poonpong emphasised that the government’s support measures, particularly in the energy sector, have been instrumental in maintaining lower prices.

The Commerce Ministry reported a year-on-year decrease in headline inflation of 0.44% in November, following a 0.31% contraction in October and a slight 0.3% increase in September. Core inflation, which excludes volatile food and energy prices, rose by 0.06% year-on-year in November.

Well within the Bank of Thailand’s target range of 1-3% but there are disturbing trends which suggest that consumers are beginning to behave cautiously

For the first 11 months of 2023, headline inflation averaged 1.41%, well within the target set by the Finance Ministry and the central bank’s Monetary Policy Committee of 1.0-3.0%. Core inflation averaged 1.33% during this period.

Despite the recent decline, the Commerce Ministry maintains its forecast for headline inflation for the entire year, predicting a range of 1-1.7%, with an average of 1.35%. The director-general expressed optimism about Thailand’s economic conditions, with the National Economic and Social Development Council forecasting 2.5% economic growth in 2023 and 2.7-3.7% growth in 2024.

However, industry experts, such as Thanavath Phonvichai, president of the University of the Thai Chamber of Commerce, noted concerns about lower prices for some fresh foods and consumer products.

This, coupled with core inflation remaining below 1%, reflects a cautious approach among consumers. Mr Thanavath raised the possibility of entering a deflationary phase, suggesting that policies like lowering interest rates might be necessary for economic stimulus.

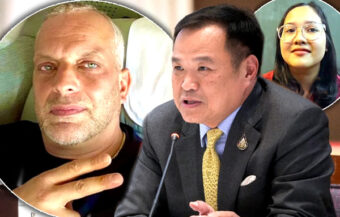

Clash and ideological divide between the Prime Minister and the Bank of Thailand have been seen in recent months because of Pheu Thai’s pro-growth agenda

The government and Prime Minister Srettha Thavisin’s commitment to maintaining economic consumption and expenditure is evident in its clash with the Bank of Thailand and Governor Sethaput Suthiwartnarueput over stimulus spending including the controversial ฿560 billion Digital Wallet giveaway as well as ongoing minimum wage discussions.

Bank of Thailand boss appears critical of the new government’s policy initiatives on the economy

While the Ministry of Labour committee recommends a modest 2.4% increase, Pheu Thai has proposed a more substantial jump from ฿350 to ฿400, reflecting a growing divide within the Thai cabinet.

At the same time, employer groups such as the Federation of Thai Industries (FTI) have been supportive of the government’s efforts to control electricity prices and its financial stimulus proposals, they have quietly voiced their concern about Pheu Thai’s plans to raise the minimum daily age rate to ฿600 by 2027 and to increase civil service pay with an 18% rise in the pipeline for the year ahead with a minimum starting salary of ฿25,000 per month for bachelor degree holders in the course of the government’s term.

Ministers and officials must achieve a difficult balance

The proposed increase in electricity prices, which could potentially impact inflation, remains a contentious issue.

Prime Minister Srettha Thavisin has vowed to limit the electricity tariff increase to a maximum of ฿4.10 per kWh, showing a commitment to balancing economic considerations with the cost of living for vulnerable households and plan to maintain the ฿3.99 per kWh for over 17 million households.

Scorching electricity costs may sear the economic recovery with a new threat to reduced inflation

Business calls for input on energy policy as cabinet agrees on ฿11 billion for electricity bill supports

In conclusion, while Thailand has experienced a decline in inflation for the second consecutive month, the economic landscape remains delicate.

The government’s interventions have played a crucial role in maintaining a lower cost of living and driving down inflation rates, but challenges persist, requiring a delicate balance between economic growth and financial stability with care for both the well-being of the economy and the population, often being a difficult balancing act to achieve.

Join the Thai News forum, follow Thai Examiner on Facebook here

Receive all our stories as they come out on Telegram here

Follow Thai Examiner here

Further reading:

Fragile, weak economy sees central bank holding interest rates and reducing 2023 growth to 2.4%

Srettha’s crisis is not just an economic one, it is a ‘3D debt crisis’ that is strangling GDP growth

Zombie Thai firms holding back economic growth as they struggle just to pay interest on bank debt

Incoherent government economic policy clashes with Bank of Thailand’s efforts to rein in debt

Economy is in troubled waters with fears for both exports and foreign tourism as 2023 winds down

Thailand faces an economic future of low growth despite Srettha’s plans because of a darker world

Another dip for the baht or are economic danger signals flashing for both Thailand and the world?

Police chief confirms 2 dead with reports of at least one more fatality in Bangkok mass shooting

Bank of Thailand boss appears critical of the new government’s policy initiatives on the economy

Concerns over household debt rising as banks report marginally lower non-performing loans

Thailand preparing for a soft landing as ‘cracks’ open up in the Chinese economy says bank chief