BANGKOK: A World Bank report this week highlights Thailand, Southeast Asia’s second-largest economy, as one of the key concerns in the region as it faces an economic contraction which may see it lose valuable human resources forever even after business restarts. The report chimed with the Bank of Thailand’s assessment which predicts a 5.3% contraction of the economy but which highlights a significant and continuing drop in the value of the baht. So far this year, the Thai currency is down by up to 10% and the trend should continue.

Thailand’s economy runs the risk of a third shock if the government does not focus its immediate efforts on restarting the tourism industry, its huge informal economy and addressing household debt after the virus has been defeated. This was the prognosis this week of the Chief Economist of the World Bank in the region as he noted that the country was likely to see a contraction in its economy of 5% for 2020 assuming efforts to control the virus are a success by the second quarter of the year. Moodys, on Thursday, changed its outlook on Thai banks from positive to negative.

Don Nakornthab, a senior director with the Bank of Thailand sees the Thai economy contracting more sharply in the second quarter of 2020.

He also has the economy contracting further in the last two quarters but to a lesser extent as the government is expected to bring the virus under control sometime between April and July.

The bank is still forecasting a loss in GDP for 2020 of 5.3% with a recovery only taking place in 2021.

All this is dependent on the Covid 19 emergency worldwide improving also in the second quarter of this year with a vaccine coming on stream in the early months of 2021.

Coronavirus emergency is devastating the less well off in Thailand’s huge and ‘invisible’ informal economy

The outlook described by Mr Don is in line with a new World Bank report which also highlights the serious long term effects of the coronavirus crisis on the Thai economy and in particular on the less well off.

Thailand’s informal sector faces devastation as Thailand enters its darkest hours in the coming weeks which may see economic activity even shut down further.

One silver lining is a downward trend in the Thai baht

The Bank of Thailand director highlighted one silver lining in the Covid 19 clouds of despair descending over the economy. This is that the Thai baht has depreciated since the beginning of the year by up to 10%.

This trend is expected to continue and will benefit the export of agricultural produce in the short term when markets begin to reopen.

The latest data also showed that Thailand’s economy had begun to improve in early February before the coronavirus crisis broke out with an increase in the export of merchandise particularly computer drives and electronic products as production moved to Thailand from China.

Even at the height of this emergency, the Bank of Thailand is continuing with its efforts to allow more foreign outflows which contributes to making Thailand more competitive.

Moodys turns negative on the Thai banking sector

On Thursday, Moodys changed its outlook on Thailand’s banking sector.

This was a complete reversal of its praise of the sector at the end of last year for its conservative approach to risk management and the supervision of the banking system by the Bank of Thailand.

Now, the rating agency says the situation will deteriorate over the coming 12 to 18 months due to the massive disruption to the Thai economy caused by the coronavirus.

The agency paints a dark picture of the world economy generally which is described as disrupted and sees the virus emergency deepening in economic terms. Even if governments manage to get a lid on the situation which is hoped for in the second quarter.

Virtual closure of Thailand’s tourism sector and cross border trade which are linked to the grey economy

The agency highlights the effects of the closure of Thailand’s tourism sector accounting for 10 to 11% of GDP. Thailand saw only 600 tourists arrive in March according to the Bank of Thailand.

It also spotlights cross border trade which plays a significant role in the small business sector and is linked to Thailand’s huge grey or informal economy.

This sector is facing a historic disruption that has only now been locked into place to defeat the virus.

Rating agency warns that this must impact the asset quality of Thai banks across the board

Moodys concludes that this must impact the quality of bank assets and debt repayment capacity of all borrowers, across the board, in Thailand.

It even states that larger borrowers and firms in Thailand will suffer more since they have lower buffers against a sudden drop in revenues due to their strong market positions and the unprecedented nature of this economic disruption.

Banks have the appropriate capital buffers it concedes to meet the challenge in the days ahead

The agency says that what was once an admirable situation with regard to debt provisions will now only be a mitigating factor in the economic tidal wave which this shutdown will generate when all matters are finally reckoned.

Notwithstanding this, Moodys concludes that Thai banks have the appropriate capital buffers to withstand the wave and challenging days ahead.

The rating firm sees the Thai banks as able to meet the situation but warns that it will be at the expense of any prospect of growth.

It predicts loan to deposit ratios at below 100%.

Moodys has, however, retained its Baa1 sovereign rating for the Thai government and notes that this will stand to the economy as the government works to battle the economic storms ahead.

World Bank warns that a third shock may follow for Thailand and other vulnerable economies in Asia

This week also saw the World Bank warn that Thailand risks a sudden rise in poverty levels in the aftermath of this crisis which is going to hit the economy hard.

This is contained in a report issued by the bank on the current emergency and its impact on Southeast Asia.

It fears that it could lead to a third shock following the trade war from last year and now the coronavirus emergency itself.

This virus-driven economic contraction caused by necessary government measures to save lives will lead to weaker domestic consumption and may exacerbate the country’s already chronic problem regarding household debt. For a long time now, this issue has been a gun positioned at the Thai economy’s head.

World Bank calls for ‘bold national action’

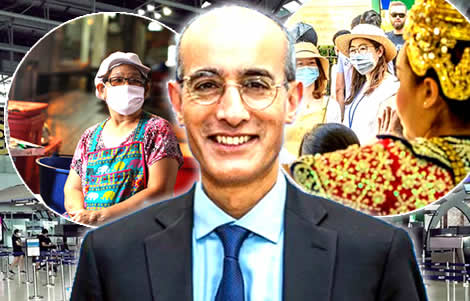

Aaditya Mattoo, the Chief Economist with the World Bank in East Asia was the lead author of the report.

‘This exceptional shock needs an exceptional response: bold national action, deeper international cooperation, and high levels of external assistance,’ he wrote.

Thailand, unlike Vietnam and other neighbours such as Cambodia and Laos, will suffer economic contraction because of this outbreak, the World Bank predicts.

Agrees with Bank of Thailand that the kingdom’s economy will contract by 5% in 2020 at worst

It concurs with the Bank of Thailand’s outlook for 2020 by estimating that a 5% contraction for the year would be its worst-case scenario at this point.

The World Bank also hones in on Thailand’s chronic personal debt problem as a major weakness in the country’s economy and one which makes it vulnerable to another shock.

Thai economy may lose valuable and irreplaceable human capital because of this shutdown

The report’s authors warn that the current downturn could see Thailand losing more of its already scarce workforce who may never return to the economy because of this setback.

Tourism and the ‘invisible’ informal economy are intertwined – both are being hard hit by this crisis

It particularly highlights the longer-term damage to the tourism industry and the country’s huge informal economy, both of which in some ways are very much interconnected.

It says that that the invisible nature of this economy may make it difficult for the government to even address the problem as it has not got a full understanding of it saying that many of its workers are ‘legally invisible’ to the government.

Calls for effective debt relief measures

Mr Mattoo and the World Bank have called for bold and imaginative measures to be taken by the government after the virus emergency to assist these people.

The answer may lie in extensive debt relief provisions.

‘For poorer countries, debt relief will be essential, so that critical resources can be focused on managing the economic and health impacts of the pandemic,’ Mr Mattoo said.

He said everything possible must be done to underpin and boost household spending to get the economy fully working again.

Further reading:

Huge demand for emergency supports with over 20 million to apply for self employed payments

Thai government responds with targeted stimulus plans to help the economy through the virus crisis

No limit on borrowing as Somkid plots the biggest stimulus package yet to address the virus crisis