Thailand’s EV dream may just be turning sour. Sales plunged in February and March 2024, challenging the government’s vision. Market shifts worldwide are raising concern about the future development of EVs. If true, the Thai government will face tough and searching questions about its longterm planning.

Sales of EV vehicles in Thailand surprisingly fell in February and March this year. The trend is coinciding with plunging sales of internal combustion engine vehicles as well as falling production. The news comes just after the opening of Thailand’s first EV production facility in Rayong and an ambitious government programme to develop the kingdom as an EV hub in Southeast Asia, supplying Indo-Pacific markets. The drops came after a surge in 2023 that ran into January 2024. If the trend persists in April amid falling confidence in EV cars, questions must be raised about Thailand’s industrial planning.

Thailand’s dream of becoming an EV super hub for a burgeoning new auto industry may have hit some road bumps. Despite a 308% rise in EV sales in the kingdom in 2023, the market has suddenly turned sour.

Indeed, January 2024 began well. EV sales for the month came to 13,653 new cars. In turn, this was 20.5% of what was already a depressed car market this year in Thailand.

Certainly, figures for the overall auto industry are shocking. This story is part of why analysts are increasingly worried about Thailand’s manufacturing base.

Business steadily built up in Thailand since the 1950s suddenly faces massive headwinds. Its transition to EV vehicles is not yet a given in the marketplace

Since the late 1950s, automobile production driven by Japanese firms has been the powerhouse of Thailand’s second-generation economy.

Unquestionably, all this has changed with the Thai government’s gamble on the EV revolution. This is a heady risk.

Domestic car sales in Thailand fell 29.8% in March.

A complex series of factors including tighter credit conditions and loss of household income was behind the outcome.

However, there is also anxiety about the future of the traditional automotive market. This has been exacerbated by the subsidised and promoted transition to EV vehicles.

March had been the tenth consecutive month of car sales declines. In addition, it was also the steepest.

At the same time, car production plunged 23.08%. These figures came from the Federation of Thai Industries (FTI), which confirmed a figure of 138,331 units in March.

EV sales drop in February and March is a shock as the industry appears to have suddenly gone into reverse drive, slowing in Europe and the United States

Nonetheless, the disappointment for the Thai government will be the sales figures for EV vehicles in February and March 2024.

There was a shocking drop in EV sales for February with only 3,635 cars sold.

In short, a 72.7% cut on the figures seen last year. The drop in EV sales was less, however, in March but still represented a 15.6% decline year on year.

The figures are supplied by the Federation of Thai Industries (FTI) and come from the Land Transport Department.

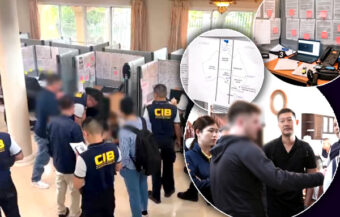

The news will be particularly painful for Thai government planners. The fall in sales comes just a month after Thailand’s first EV production centre opened in Rayong.

High hopes in January with a Rayong EV factory opened by China’s Great Wall Motors producing the cheapest EV for sale in Australia. Things have changed

Opened amid fanfare in mid-January by Deputy Prime Minister and Minister of Commerce Phumtham Wechayachai, the Great Wall Motors (GWM) is producing iconic and popular EVs for both the domestic Thai market and export markets.

It was reported that even the batteries for these fun-looking cars are substantially produced at the Rayong plant.

At the same time, the cheapest EV car, the GWM Ora is made there.

This is aimed at Thai consumers and export markets such as Australia. The Ora is presently the cheapest EV on sale in Australia as the Chinese firm slashes prices.

Up until the slump in February, Chinese firms such as GWM, BYD, and XPeng had been seen as the future of the auto industry in the kingdom.

Generous Thai government subsidies even on imports. Plan is for firms on the scheme to open factories in the kingdom by 2026, BYD signed last September

This is supported by generous subsidies initiated by the Thai government.

In short, these were initiated under PM Prayut Chan-o-cha. Dubbed EV 3.0 and EV 3.5, the government’s schemes offer subsidies. These range from ฿70,000 to ฿150,000 for firms to sell EVs in the kingdom.

Under the schemes’ terms, companies taking advantage of the offer are expected to open production centres for EVs by 2026.

The current scheme introduced by this government is EV 3.5. It runs from 2024 to 2027.

Jury still out on EV vehicles but with its back against the wall, Thailand is all in for the ride at high torque

Prime Minister Srettha in Japan talking up EV investments in Thailand’s vital automotive industry

BYD signed an agreement in September 2023 to open a manufacturing plant in Thailand for its cars.

However, the Chinese firm, in March, put the brakes on its plans to develop a production facility in northern Vietnam.

At length, it blamed poor worldwide sales and the industry price war for the decision.

Board of Investment (BOI) is confident that Chinese battery manufacturers are coming to assist Thailand’s EV hub vision. However, reality now is different

Certainly, the Thai Board of Investment (BOI) continues to tout pledges and prospects.

These are related to Chinese firms subsidised by the Chinese government that may seek to establish battery plants in Thailand. For now, however, Thailand is importing more EVs than it manufactures.

At the same time, it is subsidising them at great expense. In effect, it is subsidising imported Chinese vehicles, replacing those made in Thailand.

The government has outlined ambitious targets.

At this time, the EV market leader in Thailand is BYD, followed by MG and NETA. However, the number of registrations so far is only in the tens of thousands. BYD leads the field with approximately 38,600 registrations.

Nevertheless, the Thai government expects this to rise to 175,000 vehicles a year in 2024. In addition, its figure for 2025 is between 350,000 and 525,000 vehicles.

Things do not look good for the Thai government’s ambitious target of 325k to 525k EVs being sold in Thailand in 2025. The World marketplace is saying No

Faced with the figures in February and March 2024, things do not look good.

In truth, this looks like an earthquake occurring under the government’s EV programme.

However, something is happening in the world market.

Nor is the trend good for the EV revolution. Significantly, Apple in March cancelled its EV car project dubbed Project Titan.

That was centred on China. Previously, it invested billions of dollars in the project. It was eventually simply sidelined as the behemoth announced a renewed focus on artificial intelligence.

At the same time, Apple is slowly moving out of China. It is moving its manufacturing to Vietnam and India. Thailand has not yet been favoured.

Then, in April, we saw Tesla as it bled financially from a price war with aggressive Chinese competitors, letting go 10% of its staff worldwide.

At the same time, warning lights flashed when US Secretary of State Antony Blinken rushed to Beijing.

In addition to Taiwan and Ukraine, he was also there to discuss, among other things, the overproduction of EVs.

EVs have become another geopolitical headache and football as European and American economic chiefs see a Chinese threat while ordinary consumers turn off

It seems EVs have also become a new geopolitical challenge in Europe and America. Both economies are threatening to impose tariffs on cheaper Chinese-made vehicles.

At the same time, sales of EVs plunged 9% in Europe in March. This came even as sales worldwide were up 12%.

However, the drop is particularly coming in areas that had adapted early to the EV craze. Sales fell in the United Kingdom, Norway, Germany and Sweden.

This comes as giant US automakers have moved to scale back EV development plans.

The US winter saw a huge problem for EV drivers with weather and range issues. Similarly, in the UK, the second-hand market for EVs collapsed in part because of the price drops on the vehicles.

In addition, newer models are using new technology. In short, 33% of UK second-hand dealers are now shy about dealing with EVs.

Pattern established of EV owners switching back to traditional cars. The car market has just been making up its mind and alas it is not good news for EVs

This has led to an entrenched pattern of drivers switching back to traditional combustion engine cars. Many cite range anxiety, the trouble of finding charging stations and the time involved in this.

Similarly, with large firms, such as the decision by Hertz to dispose of its EV rental hire fleet due to excessive wear and tear.

At the same time, falling price supports and indeed the ending of subsidies has been an issue. For instance in Germany.

Moreover, there is another underlying factor. Younger generations of consumers are shifting away from cars altogether. This is also a market phenomenon.

Particularly for urban dwellers.

Figures from Europe show car mileage peaked in 2000. A recent survey by Field Dynamics shows the average UK car owner only drives 100 miles a week. It is the same story stateside. Half of car journeys are less than three miles.

EV cars already sold and tested by Green political thinkers. They are a minority despite insistent flowery rhetoric from national and international leaders

This had been thought a boon for EVs. However, sentiment in America is rapidly turning against the EV, particularly due to poor user experience. The other factor is the proportion of people driven by Green thinking.

All of these were already reached by the market spiel for the cars. In short, they are a small minority.

Herein we have another lesson of not mixing politics with economics.

Sound business is market-driven despite the flowery rhetoric of international political bodies.

This is the hard lesson learned also during the pandemic era. One, it appears, that is lost on China which is all in on the EV revolution.

On the other hand, more and more data suggests that EV cars are not ultimately environmentally friendly. Neither are they economical as range issues develop and batteries develop problems.

In addition, they continue to be a higher-priced option than internal combustion vehicles.

There is a place for EV vehicles in public transport

Undoubtedly, there is room for EVs in the public transport sector provided they can stand the wear and tear.

Thailand has seen EV buses and public transport vehicles added to the fleet in 2023 and 2024.

Indeed, Toyota, a company which is sceptical about EVs, has begun testing its EV vehicles in Pattaya. The test vehicles are based on the popular Hilux Revo. Nine were launched on the streets of the resort city this week.

They are to be used on fixed routes as Songthaews. In short, a cheap and cheerful Thai public transport option where users climb into the back.

Meanwhile, there is a market trend that is turning into reality in Europe.

That is a move towards low-cost electric vehicles. Essentially, electric bikes or mini vehicles sold for prices well below those of cars.

Surprising trend toward inexpensive EV motorbikes and small city transport vehicles used for short distances which are cheaper to buy, run and park

These vehicles are increasingly popular in urban centres. The market is using established brand names such as Porsche and Maserati. These iconic firms are designing attractive products for sale at a lower entry level cost.

They are cheap to purchase, cheap to run and easy to park.

In the meantime, Thailand’s lofty vision to become the Southeast Asian hub for EV vehicles is just about intact. However, the warning lights are flashing.

At the Motor Show in Bangkok earlier in April, most executives accepted that this year, EV sales would be below target.

Questions must be asked about long-term industrial planning in Thailand and government policy if the EV revolution flops as it might do later this year

The blame was put on consumers for trying to take advantage of falling prices.

‘The price war is an obstacle in the EV market as it causes unstable car prices, making buyers hesitant,’ disclosed Mr Wallop Chalermvongsavej. Mr Wallop is the managing director of Hyundai Mobility Thailand. ‘They prefer to wait and see as they don’t know whether EV prices will keep decreasing.’

In the meantime, Thailand’s established internal combustion engine manufacturers are being decimated.

Therefore, the situation raises disturbing questions about the government’s long-term industrial planning. Especially if EV sales instead of surging, plunge further as we saw in February and March.

One thing is certainly true, the one-way EV dream is over.

Join the Thai News forum, follow Thai Examiner on Facebook here

Receive all our stories as they come out on Telegram here

Follow Thai Examiner here

Further reading:

Prime Minister Srettha in Japan talking up EV investments in Thailand’s vital automotive industry

Land Bridge to PM Srettha’s economic policy dreams on the agenda with a 2029 launch date

Transport ministry looks at launching Thailand’s own shipping line to support economic growth

RCEP deal agreed as India opts out – busy Bangkok ASEAN summit concludes on a low-key