Vietnam wins big with a 20% U.S. tariff, while Thailand is hammered with a 36% rate, sparking fears of potential investor flight, collapsing U.S. exports, and political uproar. As Bangkok reels, critics demand resignations and warn of long-term economic devastation.

On Tuesday, the People’s Party demanded the resignations of Finance Minister Pichai Chunhavajira and Foreign Minister Maris Sangiampongsa. Thailand has been crushed in tariff talks with the United States. A White House letter on Monday slammed a 36% tariff on Thai goods—while Vietnam got only 20%. Vietnam outplayed and out-negotiated Thailand, giving US companies perks Thailand can’t match. This deal delivers a brutal blow to Thailand’s economy. It threatens not just exports but also foreign investment, which will almost certainly flee to Vietnam’s cheaper tariffs and lower cost economy. The damage won’t just hit now—it will devastate Thailand long-term. The US is cutting ties with China and its allies. Thailand is getting left behind in the race to do business with its biggest customer.

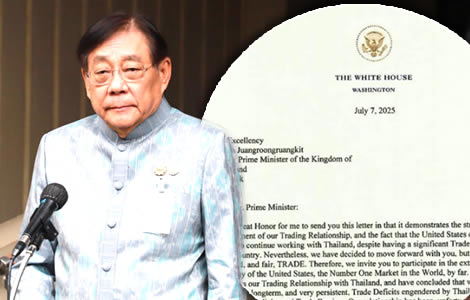

Within 48 hours of Thailand’s government denying the existence of a proposed 36% U.S. tariff, confirmation arrived. The confirmation came in the form of a letter dated July 7, addressed to Acting Prime Minister Suriya Jungrungruangkit. It delivered a clear and crushing blow to the Thai government’s hopes of tariff relief.

Although the letter began by praising the U.S. economy, it quickly took a stark turn. It stated the U.S. would impose a 36% tariff on all Thai imports. According to the letter, the U.S. seeks to reduce its persistent trade deficits with several partners, including Thailand.

More importantly, the U.S. administration labelled its trade relationship with Thailand as “far from reciprocal.” As a result, the 36% rate would take effect from August 1, 2025.

U.S. letter confirms 36% tariff on Thai goods and closes off any path to negotiation or retaliation

Moreover, the letter warned that if Thailand imposed counter-tariffs, the U.S. would respond with even higher duties. This signalled an end to any room for tit-for-tat trade retaliation.

Despite ending with the hopeful line, “You will never be disappointed with the United States of America,” the impact on Thailand was harsh. The message was clear: Thailand had failed to secure favourable terms.

In fact, the consequences could be severe and long-lasting. Thai exports to the United States will now face massive headwinds. Additionally, U.S. private investment in Thailand is expected to slow or even stop altogether.

By contrast, Vietnam, Malaysia, and Indonesia all fared better under the new tariff regime. Vietnam secured a reduction to 20%, down from 46%. Malaysia’s tariff rate was set at 25%, and Indonesia’s at 32%.

Notably, Cambodia, previously under a steep 49% rate, saw its tariff reduced to 36%—the same rate now slapped on Thailand. The message from Washington was that negotiation style and transparency mattered.

Vietnam, Malaysia and Indonesia rewarded for openness, while Thailand faces penalty for unclear tactics

Vietnam’s deal was more than just successful; it was strategic. In its agreement, Vietnam committed to 0% tariffs on all U.S. imports. Furthermore, it ensured that Chinese exports via Vietnam would face a flat 40% tariff. This clever clause appealed to U.S. interests.

Meanwhile, Thailand’s negotiation strategy drew criticism for its lack of clarity and sincerity. According to insiders, Thai officials provided contradictory information to their U.S. counterparts.

A case in point was the Uyghur deportation scandal earlier this year. Over 40 Uyghurs were sent to China on February 27, despite U.S. objections. The incident triggered a diplomatic freeze. Foreign Minister Maris Sangiampongsa was reportedly barred from entering the U.S. last week.

As this unfolded, Thailand’s credibility fell further. Minister of Finance Pichai Chunhavajira came under fire for relying on outdated rhetoric, such as “win-win cooperation.” Critics say this approach failed to resonate with the current American worldview.

During the most recent trade talks, Pichai met Jamieson L. Greer, the lead U.S. negotiator. Desperate efforts to save face followed. The Thai side offered sweeping concessions. According to reports, Thailand proposed zero tariffs on 90% of U.S. imports on Sunday.

Diplomatic stumbles and late offers expose deeper failures in Thailand’s strategy and global credibility

Although this was a dramatic offer, it came too late. Vietnam had already secured the more attractive deal. Furthermore, Vietnam’s agreement appeared cleaner, more open and better aligned with American strategic goals.

Thailand now finds itself at a crossroads. The United States, Thailand’s largest and most profitable export market, has taken a tougher stance. It appears to be choosing new preferred partners in Southeast Asia.

Although Thailand has long relied on balancing ties between the U.S. and China, that strategy is faltering. The current administration in Washington is demanding clear allegiances. There is little tolerance left for ambiguity.

At the same time, Thai politicians are facing growing domestic criticism. The People’s Party is demanding the resignation of both Pichai and Maris. Many believe the government failed to appreciate the gravity of the U.S. negotiations.

Meanwhile, prominent economists are issuing dire warnings. Dr. Kobsak Pootrakool said Thailand is in danger of losing its status as a competitive export hub. Because of the higher costs, U.S. importers will likely shift orders to cheaper alternatives.

Loss of U.S. trust and higher costs put Thailand’s export hub status and investment future at risk

Indeed, Vietnamese labour and production costs are already lower than Thailand’s. Now, with a better tariff structure, Vietnam becomes the obvious choice for foreign investors.

Factories operating in Thailand may begin relocating. Not only will Thailand see lost export orders, but investment capital could also flee. Tens of billions of baht in future projects may vanish.

As investment dries up, factory output will likely shrink. Unemployment will rise as businesses reduce hiring or lay off workers. As a result, the domestic economy will take a hit.

Consequently, lower incomes and joblessness will erode consumer spending. Small businesses, restaurants, and service providers will feel the squeeze. Thailand’s economy, already fragile, could slide into broader contraction.

Therefore, the tariff dispute is no longer a simple trade issue. It has become a major threat to national economic security. The situation is especially perilous given Thailand’s ongoing political instability.

Factory flight, job losses and investor pullback deepen threat to Thailand’s fragile economic base

Prime Minister Paethongtarn Shinawatra is facing an ethics petition in the Constitutional Court. If the petition is upheld, she may be forced to step down. Meanwhile, the acting prime minister lacks the authority to appoint a new cabinet or dissolve Parliament.

Coalition partners are growing uneasy. Political alliances are fraying. Public confidence in the government is declining.

The economic shock, combined with political gridlock, has created a dangerous environment. As one analyst put it, “Thailand is being hit by external shocks while paralysed internally.”

President Trump’s tariff letter, posted on Truth Social, included personal messages to leaders of the 14 affected countries. Thailand’s rate of 36% was among the highest. Only a few others, like China and Turkey, received similar treatment.

For comparison, Japan and South Korea received 25% rates. This suggests that the U.S. used differentiated assessments based on trade balance and political alignment.

Additionally, the U.S. warned that retaliatory tariffs would only trigger steeper penalties. Trump’s letter even offered an exemption path. Companies could avoid the 36% rate by manufacturing directly in the U.S.

Political deadlock, investor fear and Trump’s tariff blast push Thailand closer to a perfect economic storm

To support this, he promised fast-track approvals and favourable investment conditions. However, such a move requires capital and long-term planning. Thai firms may not be in a position to make such drastic adjustments.

Meanwhile, Deputy Prime Minister Pichai expressed continued optimism. Speaking at Government House, he said Thailand had submitted a revised trade proposal. The offer included a 70% reduction in the U.S. trade deficit within five years.

He also promised a fully balanced trade relationship within seven to eight years. Nevertheless, there is no sign that Washington will budge.

Dr. Pipat Leungnarumitchai of KKP Research said this is “The Art of the Deal” in action. The U.S. is playing hardball, forcing countries to make immediate concessions.

In his view, Thailand should consider opening its agricultural markets. With sufficient buffers and compensation, this could form the basis of a new deal. But time is running out.

U.S. signals no shift while Thai officials scramble for concessions as clock ticks on looming tariff blow

The 36% tariff will apply to all Thai exports across industries. Electronics, garments, processed foods, and auto parts will suffer first. Larger exporters may try to shift focus to other markets, but global demand remains soft.

Small and medium-sized enterprises, however, will be hit hardest. Many lack the capacity to pivot or absorb losses.

The Thai baht has already come under pressure. Investors fear capital flight and reduced foreign direct investment. Stock markets have responded with volatility, especially in export-heavy sectors.

The government has announced plans to allocate ฿50 billion from its stimulus budget to cushion the impact. Still, experts warn this may be insufficient if the tariff persists.

To navigate the crisis, Thailand must act on several fronts. First, renewed high-level talks with Washington must occur quickly. Second, economic relief packages must be expanded and targeted.

Currency pressure rises as SMEs face collapse and stimulus measures fall short amid investor retreat

Third, the political vacuum must be addressed. A stable government is crucial for future negotiations.

This is not merely a tax issue. It is a challenge to Thailand’s entire economic architecture. The fallout from these decisions could shape the country’s economy for decades.

Scamble for Thailand’s future place in the emerging, divided new world under Trump. Mixed U.S. signals

Turning point for Thailand as it awaits what could be a heavy economic sting from finalised US tariffs

Thailand strikes out at efforts to clinch a US tariff deal. Finance Minister Pichai now on the way home, not giving up

With the economy sputtering, the top Thai team flies to the US to secure a favourable trade deal with Trump

Time is short. The tariffs will begin on August 1. What Thailand does in the next few weeks will matter immensely. If it fails to act decisively, it may lose its strategic standing in Southeast Asia.

The U.S. has made its position clear. Now, Thailand must decide which direction to take. There is no more middle ground.