Evil loan sharks smashed! Thai police arrested five suspects running illegal lending rings charging up to 720% interest, leaving borrowers like traders penniless, harassed, and threatened. Authorities vow more raids on predatory lenders exploiting desperate victims.

On Sunday, police from the Crime Suppression Division (CSD) and Technology Crime Suppression Division (TCSD) smashed two ruthless illegal lending rings operating in Ubon Ratchathani and Bangkok. Charging extortionate interest rates of 626% to 720% per year, the gangs preyed on desperate borrowers seeking small loans to stay afloat. Victims were crushed under daily payments, harassed, and intimidated when they couldn’t keep up. Five suspects were hauled into custody, as police vowed more crackdowns on what they call predatory financial exploitation. The whistleblowers—struggling small traders—had been pushed to the brink by spiralling debt and relentless pressure on a daily basis.

On Sunday, Thai police launched a sweeping crackdown on illegal money lending operations. Officers from the Technology Crime Suppression Division (TCSD) raided criminal loan networks in Ubon Ratchathani, Bangkok, and Ayutthaya. The targets were ruthless loan sharks exploiting the public through unlicensed lending and extreme interest rates.

In Ubon Ratchathani, police arrested two 24-year-old suspects at a market in Muang District. Significantly, they were caught collecting money from multiple borrowers. The suspects, later identified as Mr. Thaksin and Mr. Naruebodee, had been running an illegal money lending business without authorisation.

The operation followed a formal complaint from a 59-year-old man. He borrowed ฿30,000 from the suspects over a year ago. However, after paying more than ฿200,000 in interest, his debt remained untouched.

Borrower pays ฿200,000 on ฿30,000 loan yet debt remains unchanged as interest spirals to 720% yearly

Despite paying ฿600 per day—equivalent to 720% interest per year—the loan principal was never reduced. Over time, the victim became financially ruined. Eventually, he turned to the Crime Suppression Division for help.

In response, police launched a discreet investigation. They soon uncovered a brutal network targeting desperate borrowers. Consequently, officers raided the site and seized critical evidence. This included a mobile phone, a black and red motorcycle, 12 ID and house registration copies, and business cards used in the lending scheme.

The two men confessed during questioning. Authorities later transferred them to Muang Ubon Ratchathani Police Station. They now face prosecution for running an unauthorised personal loan business and charging illegal interest rates.

Meanwhile, another major operation unfolded in Bangkok. This time, TCSD Sub-Division 5 targeted a transnational online loan syndicate. The group was composed of Vietnamese and Korean financiers working through Thai intermediaries.

Interest rates hit 626% annually as an online loan gang traps small traders across multiple provinces

After receiving complaints from Ayutthaya province in August, police began monitoring suspicious transactions. It soon became clear the gang was charging 1.715% interest per day. That figure translates to 51.45% monthly—or a shocking 626.25% per year.

As a result, many low-income merchants and small business owners were forced into debt traps. For instance, these loans did not require documentation or guarantors. Instead, suspects performed a quick visit to inspect the business. Once approved, funds were transferred instantly—minus deductions for interest.

Importantly, the gang did not stop at financial exploitation. Debtors who defaulted were afterwards harassed at their homes, workplaces, or shops. Victims were followed, threatened, and publicly humiliated.

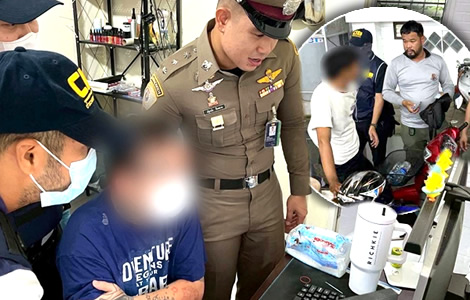

On September 14, the investigation reached a turning point. Officers obtained court permission to search three targeted locations. They arrested three suspects: Mr. Natthaphong (36), Mr. Winet (28), and Mr. Thirawut (34). Police withheld their full names pending further investigation.

Police seize tech, phones, and documents as cash-rich syndicate exploits those locked out of bank credit

From the scene, police seized a large cache of evidence. This included one desktop computer, two laptops, 13 mobile phones, eight bank account books, and 10 sets of loan-related documents.

The syndicate is believed to have generated a cash flow exceeding ฿30 million. It operated across Bangkok and nearby provinces, targeting borrowers unlikely to access bank credit.

Senior officers led the operation. Police Col. Mekphisan Sriphirom coordinated the raid with Police Lt. Col. Pakin Sukphrom, Police Lt. Col. Sineenat Cherdchutrakulthong and Police Lt. Col. Phichyakorn Tangrod.

All three suspects were charged with operating an unauthorised personal loan business and charging interest beyond legal limits. They were transferred to TCSD Sub-Division 5 for legal processing.

Although the suspects operated under the radar, mounting complaints led police to investigate. This is because the gang’s informal methods, including verbal threats and physical stalking, made victims fearful of retaliation.

Police vow witness protection as fear of retaliation grows among victims of illegal loan syndicates

However, police stressed that such intimidation will not be tolerated. Certainly, officers assured the public that witnesses and victims will be protected.

Pol. Col. Wittaya Sriprasertphap, Commander of the Crime Suppression Division, emphasised the severity of the offences. He stated that unregulated money lending poses grave risks to Thai society.

“These are not just financial crimes,” he said. “They destroy lives, families, and livelihoods. We are committed to dismantling these networks, wherever they hide.”

Later, officials said they believe more victims may come forward. Meanwhile, police have urged anyone affected by similar loan scams to report to the Crime Suppression Division.

Police believe more syndicates will surface as crackdown continues on illegal transnational lending networks

At the same time, investigations continue. Police suspect these loan shark operations may be part of a broader transnational criminal structure. Follow-up raids and surveillance are already underway.

Ultimately, Sunday’s operations have delivered a powerful message. Illegal loan sharks—local or foreign—will be hunted down and prosecuted.

For now, the suspects are in custody. But according to investigators, many more names remain on the radar.

Economy still holding its own with growth of 2.3% targeted. Faltering tourism and bad debts are threats

The rise of a new evil. Car pawning rings busted by the police fighting a new and appalling crime wave

Cunning loan shark racket offering loans secured on iCloud access to iPhone devices smashed in Bangkok

The police have promised one thing: This is only the beginning.

It comes as Thailand’s grassroots economy is left in turmoil with a shortage of cash and financial liquidity. This has particularly hit small traders in the black, unregistered economy. Both loan networks linked to Sunday’s operations concerned victims like these.

Join the Thai News forum, follow Thai Examiner on Facebook here

Receive all our stories as they come out on Telegram here

Follow Thai Examiner here

Further reading:

Husband of borrower with breast cancer mowed down loan shark following pause in payments refusal

Government’s household debt efforts in addition to plans to inject ฿500 billion into the economy

Srettha’s crisis is not just an economic one, it is a ‘3D debt crisis’ that is strangling GDP growth

Zombie Thai firms holding back economic growth as they struggle just to pay interest on bank debt

Incoherent government economic policy clashes with Bank of Thailand’s efforts to rein in debt