The popular payment platform is in crisis mode in Thailand as it scrambles to meet demanding regulatory requirements and pursue a relaunch of its service as a fully compliant Thai based entity. However, the firm faces even more significant and fundamental challenges both in Thailand and around the world not only with an evolving, more sophisticated and demanding payment service market but also real questions about its practices which have seen it faced with and making out of court settlements in class action lawsuits in the United States. The latest case was filed in January over its security tactics and the freezing of user accounts without notice or adequate explanation.

The Bank of Thailand, on Friday, announced that it was intervening to help US payments service provider PayPal which has seen its business in Thailand severely disrupted over the last year as it works to comply with a tightening local regulatory environment for online payments. For many small concerns in the country including those operated by foreigners, however, the PayPal era appears to be coming to an end as the once-popular service stumbles from one crisis to another with many users at the same time finding their accounts frozen overnight or limited in their use of the payment platform even after decades-long relationships without any notice or proper explanation beyond a cursory reference to the site’s changeable and increasingly restrictive terms and conditions.

The Bank of Thailand has intervened to try to iron out difficulties being experienced by PayPal Thailand as it attempts to move from being a foreign payments service to a Thai based service in full compliance with the country’s changing laws on financial payments.

This follows an announcement in the last week by the firm which is currently operating under the supervision of the Thai central bank, that payment functionality will be extremely limited to just credit card transactions through the company’s guest checkout function from March 7th next.

PayPal has suspended all new account registrations in Thailand until the firm relaunches in the kingdom

In addition, PayPal has announced that it has suspended all new account registrations for both personal and small business operators until the firm is in a position to proceed with its reorganisation and relaunch in Thailand.

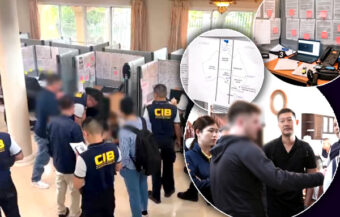

On Friday, Deputy Governor of the Bank of Thailand with responsibility for Payment Systems Policy and Financial Technology, Ms Sirithida Phanomwan Na Ayudhya said the bank was helping to expedite discussions between PayPal Thailand and local regulatory agencies including the Office of the Anti-Corruption Commission.

Tighter control and regulations imposed on PayPal as the US service provider is now licenced in Thailand

It is understood that the basis of the problems being experienced by PayPal is tighter controls and restrictions being imposed on the firm as it seeks to comply with complex money laundering requirements and new tax reporting rules as Thailand’s government agencies seek to extend more control over the kingdom’s flourishing digital economy as part of the country’s effort to expand its tax base.

It is also understood that further complications have been caused by the kingdom’s plans to overhaul its digital payments framework as the Bank of Thailand seeks to control the exploding use and ownership of cryptocurrency and digital assets in Thailand to ensure the stability of the banking system.

Bank of Thailand emphasises strong quality control standards to ensure only genuine financial activity

On Friday, the Bank of Thailand reaffirmed its duty to make sure that all payment service operators and financial institutions in the kingdom have a strong quality control system to ensure that all payments are naturally occurring within the economy and linked with bona fide account holders.

This includes compliance with the kingdom’s demanding ‘Know Your Business’ standards as the holder of a banking licence in Thailand.

Similar requirements have been rigorously imposed on Thailand’s new cryptocurrency exchanges and other new participants in what is a fintech revolution in the kingdom as the country’s profitable banks begin to take a stronger stake in the digital economy.

Thailand’s first unicorn success story, hailed by Bangkok’s markets, turns over ฿9 billion a day

The purchase of a 51% shareholding in Bitkub, the kingdom’s leading cryptocurrency exchange with over 90% of the market, by Siam Commercial Bank in an ฿18 billion deal which is expected to be finalised in the coming months, is being seen as a major step in this process with the central bank encouraging other established financial institutions to broaden their digital base with a proposal to allow firms to hold multiple banking licences.

Paypal, across the world, experiencing a crisis as the online payment environment becomes more complex

PayPal is currently experiencing a crisis of confidence not just in Thailand but across international markets as the digital payments environment is changing rapidly in response to moves by governments worldwide to exercise more control with the US firm’s regulatory circumstances or status becoming the subject to closer examination.

This is despite enhanced user engagement being highlighted by some analysts of the firm as it seeks to recalibrate its raison d’etre while at the same time falling into line with tighter regulatory controls.

A gauge of the firm’s increasingly challenging situation can be seen from its foray into cryptocurrency payments even though it is illegal in China and facing blocks in other countries for payment purposes including Thailand.

PayPal emerged as an internet favourite decades ago

The payment platform has over 327 million users worldwide.

Although no exact figure is available for Thailand, the payments service had, up to recently, been considered essential for any online firm or business operating outside the kingdom’s borders.

The firm has, in the past used, banking licences in Luxembourg and other tactics in various countries to work around the fact that it does not have a banking licence in each country that it operates in having emerged swiftly as an internet favourite decades ago because of its flexible nature and simple mode of operation.

PayPal has also been the subject of bitter and ongoing legal action in the United States and elsewhere for its modus operandi of freezing user accounts often with substantial balances without notice or indeed adequate explanation.

Latest class action lawsuits in the USA over its policy of freezing accounts without notice or in-depth explanation to account holders filed in January

The latest lawsuit was filed this January by three American plaintiffs, two in California and one in Chicago, after PayPal froze their accounts in such an arbitrary manner, which appears to be its standard practice with a pattern of cases against the firm going back over the last two decades.

In Oakland California, in March 2017, before a judge, the firm settled a case with plaintiffs and agreed to pay over $4 million in a class-action lawsuit related to unexplained account closures in a case initiated by the lead plaintiff, Moises Zepeda, who sued the firm after he found his account limited overnight as well as access to his funds without adequate explanation except for a reference to security.

Ongoing reports of Thai based account holders who have had their accounts here frozen without notice

There are ongoing reports of similar situations and instances in Thailand with one user, an established Thai firm, telling the Thai Examiner in recent days that written requests by registered post to the firm’s headquarters in Lumpini, Bangkok have gone unanswered while others have been told by telephone support operatives that they were unable to explain the closure of their accounts.

Over the last two years, there has been a growing number of complaints in Thailand from small business operators including expats and foreign-owned firms engaged in overseas commerce where accounts of long-standing have been frozen without proper explanation except for repeated reference to the firm’s fast-changing terms and conditions of use including the right it reserves to exclude a range of services and products which are prohibited under its terms and conditions or services deemed illegal under either US or local law.

Afterwards, they were sent standard innocuous replies which offered no further explanation except for a circular reference to the site’s terms and conditions.

Bank of Thailand defends its strict regulation of online payment service providers in order to protect the kingdom against potential fraud and terrorism

The latest case in California before the courts seeks punitive and exemplary damages against the firm for its behaviour.

On Friday, the central bank highlighted the growing threat to consumers and the banking system from fraudsters and the need to guard against parties engaged in terrorist activities as reasons for its imposition of strict operating criteria for PayPal Thailand.

In recent days, PayPal explained to its existing customers in Thailand what was happening as it announced a near freeze on its economic activities in the country on a temporary basis.

‘For many months, we have been working diligently on the relaunch of PayPal in Thailand. As a locally-licensed payments provider, we have been gradually updating our products and processes to ensure we comply with all applicable Thai laws. We had hoped to start welcoming more Thai customers in the next phase of our relaunch this March,’ the company’s statement said. ‘Regrettably, we need more time to reach this next phase and to extend our services further in Thailand.’

No payments from a PayPal wallet or account balance from March 7th for Thai users, only guest credit cards

In this respect, it confirmed that no payments using the PayPal wallet or account balance will be possible for Thai based users from March 7th.

‘They will be able to withdraw any balance in their PayPal wallet to their bank account,’ PayPal announced. ‘Consumers in Thailand will still be able to make payments using a debit or credit card to merchants which offer the Guest Checkout function. New account registration for consumers will not be available until further notice.’

All commercial operators require a 13 digit ID from the Department of Business Development at the Ministry of Commerce under PayPal’s new account criteria

Among the changes that have been ushered in by PayPal so far is a requirement that all business concerns supply their 13 digit business identification number while any shareholding in a company in excess of 25% must be fully certified to the payments service provider.

New regulations in Thailand in recent years also include the imposition of a digital tax or value-added tax payable by non-resident operators on all services provided within the kingdom.

This tax however only applies to companies or business concerns with a turnover above ฿1.8 million per year which would, of course, include PayPal.

Thailand is in line with many of its peers in Southeast Asia in introducing stricter regulation on internet-based activities although Malaysia introduced its 6% digital tax on the 1st January 2020 while the kingdom brought in its own provision only in September last year at 7%.

New laws on internet services in the US together with heightened local regulation and changing corporate policies have combined to restrict flexibility

Part of the problem being experienced by foreigners in Thailand who use PayPal and in particular foreign owners of small business concerns is that they are caught between expanding Thai regulatory requirements and PayPal’s own extension of its terms and conditions of use driven by the firm’s corporate policies and new laws enacted by the US Congress which have become quite restrictive.

There are also complaints about the latest information requirements from PayPal and its cumbersome online data entry system which is reportedly difficult to navigate and does not allow users to correct mistakes.

An example of this is the status of a long term business user who spoke to the Thai Examiner this week:

‘My PayPal account will be closed on February 18th after 17 years in operation. We can’t submit personal identification details for executives, shareholders and staff even though our firm has been a reputable and long-standing one for 17 years. It is demanding a personal Thai national id number for staff and shareholders that match their ID cards but won’t let us amend their names and refuses to accept valid ID information.’

‘If we add further entries, it tells us we have too many. The system is simply inflexible. It’s a horrible situation. This has become a noticeable problem with PayPal also as it has tried to become a Thai service, it seems to have forgotten its earlier easy to use qualities.’

‘To be honest, I think Paypal has had it. It has failed to keep abreast of the nuanced realities in the world today. It’s just become too difficult and unhelpful to interact with. I am seriously thinking now of closing the account altogether since we’re using other platforms although I’ll try one more time to phone them on Monday. I’m pretty disillusioned with the service and fed up with the way we’ve been so shabbily treated over the last few years. Everything with PayPal now is just way too much trouble and takes up too much time. We were once very enthusiastic about it which is the only reason why we still put up with this latest bother.’

Former PayPal users increasingly resort to new service providers such as Wise and credit cards

The decline of PayPal in Thailand has seen users in the country in the last four years rely more on credit card services and an expanding range of payment and money transfer services such as the fast-expanding Wise international payment service to make payments using the international banking system while also operating strong anti-money laundering procedures and client verification.

In Thailand, some of the more adventurous and independent-minded types among the population have switched to using bitcoin or cryptocurrency which is something that is being warned against and discouraged by Thai regulatory agencies and many other central banks around the world.

PayPal is probably the internet’s most well-known payment platform that had, up to recent years, carved out a niche that is suddenly being filled by new services in a fast-changing world where national governments are increasingly imposing regulations on the internet related to trade and commerce around the globe.

Established itself in Thailand in 2016, initially had plans to expand in the country with a better service

The US firm established itself in Thailand in 2016 as PayPal (Thailand) Company Limited and initially talked of expanding its customer base in Thailand and providing a higher level of customer service.

However, that proposition unravelled as the firm came under pressure to adapt to the burdensome and quickly changing local regulatory environment here and legal interpretations which are somewhat different to the United States.

Thailand’s financial system and regulatory agencies are far more conservative and traditional in their interpretation of the law concerning the status and nature of what is an acceptable use or not.

This is particularly so as officials are tasked by the government with extending government control to online activities with more demanding reporting requirements.

Disappointing situation for foreigners operating businesses in Thailand receiving money from abroad

The result has been a disappointment for many long term Thai users engaged in small business concerns often with international clients.

Foreign nationals or expats living in Thailand often operating sideline business concerns have also been hit severely.

A key date for PayPal users in Thailand is February 18th next when small business account holders of the payment platform will be required to submit new identity information and agree to yet another set of revised and expanding terms and conditions.

The new regime will require all commercial operators to submit a business identification number and other documentary evidence to comply with Thailand’s new financial regulation standards.

Digital tax charged on all services to local users as PayPal Thailand is treated as a service provider

PayPal business users are advised to supply their commercial registration number issued by the Department of Business Development at the Ministry of Commerce to the service platform to open a business account with Paypal.

PayPal already imposed the government’s new digital tax at 7% of value-added tax on all services provided through PayPal Thailand to Thai based users whether they are business account holders or normal users.

This has come about as PayPal Thailand, as a registered Thai entity and banking licence holder, is properly treated as a service provider in Thailand meaning that all invoices processed through it in the kingdom in respect of Thai based customers are subject to the government’s new digital tax.

Join the Thai News forum, follow Thai Examiner on Facebook here

Receive all our stories as they come out on Telegram here

Follow Thai Examiner here

Further reading:

Thailand’s first unicorn success story, hailed by Bangkok’s markets, turns over ฿9 billion a day

Thailand embraces the world of cryptocurrency as bond market to move into the blockchain era

Industry leaders and central bank all warn that foreign tourism must return to avoid a collapse

Fact – only 6,556 visitors arrived in Thailand last month compared to 3.95 million in December 2019

Desperate foreign tourism business concerns are clinging to straws as they try to survive the crisis

Challenge of the virus and closure to tourism leads to major long term changes in the Thai economy

Finance Minister says economy must pivot away from tourism with a switch to S-Curve industries

Strengthening baht predicted as investors bet on a reopening of Thailand to mass tourism in 2021

World’s biggest free trade deal just signed will be a huge boost for the Thai economy and exports

RCEP deal agreed as India opts out – busy Bangkok ASEAN summit concludes on a low key

Chinese FM to visit Thailand in a Covid battered world of raised tensions and potential conflict

Prime Minister indicates that the cabinet reshuffle will be complete very shortly with no problem

Thailand’s economy has become dependent on government expenditure to stay above water

Thailand and US aim for a new more ‘proactive’ trading relationship as ambassador meets Prayuth

Rice price spike but drought conditions to recede – security concern for the Mekong river